The APAC region has outshone other regions with a 1216% increase in its fintech index, according to analysts.

Since 2000, Asian fintech stocks have experienced remarkable growth, increasing by 1200%, according to industry experts.

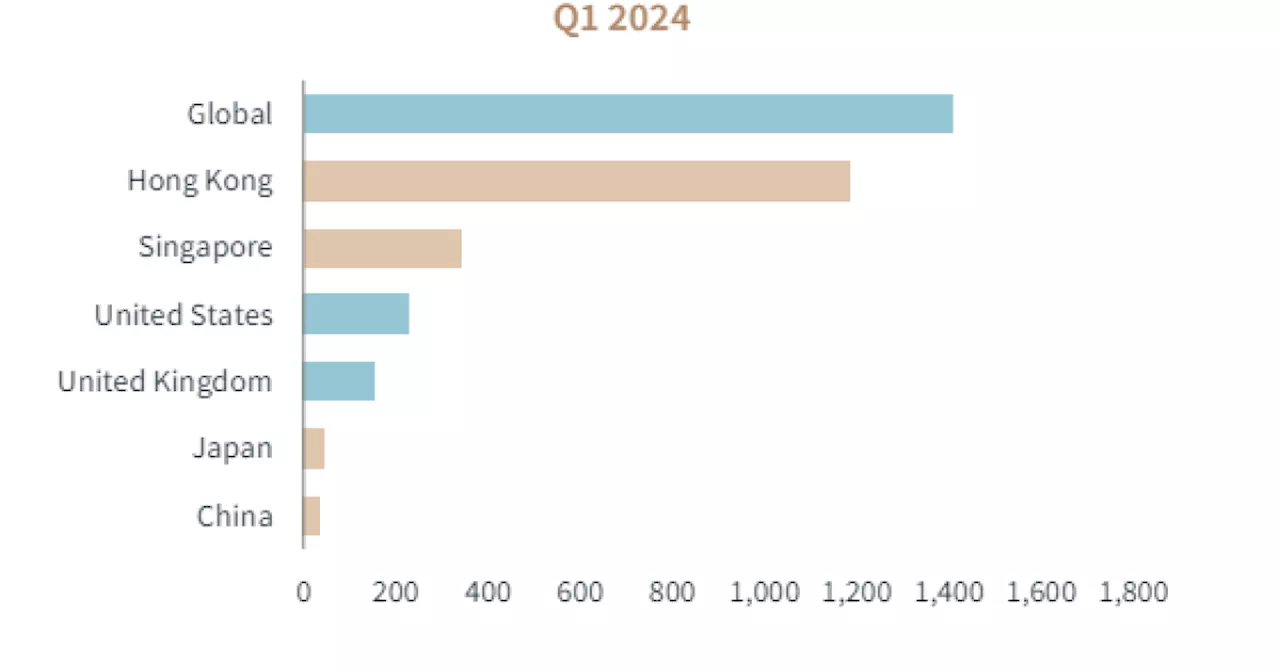

The UFGFI has grown by over 300% since Jan 1, 2000, reaching 413.62 points by the end of 2023. This rise is equivalent to a market capitalisation of US$5.43 trillion .The APAC region has outshone other regions with a 1216% increase in its fintech index with the UnaFinancial APAC Fintech Index , reaching 1,315.54 points.

In terms of regional distribution, North and South America lead with 122 companies, with 40.26% of the index. APAC follows with 101 companies , Europe with 63 companies , and the Middle East & Africa with 17 companies . To compare UnaFinancial’s regional findings with global benchmarks, results were recalculated starting August 2004. The Asian index UFAFI demonstrated a 1255% increase. This is higher than the S&P 500, which rose by 333% over the same period.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

![]() SGX welcomes ETF tracking APAC financial institutionspstrongIt has S$47m in assets under management at launch./strong/p pSGX Securities has officially welcomed the Lion-OCBC Securities APAC Financial Dividend Plus ETF, an ETF with S$47m in assets under management (AUM) that tracks the region’s financial sector. This is reportedly the world’s first ETF tracking the APAC financial sector.

SGX welcomes ETF tracking APAC financial institutionspstrongIt has S$47m in assets under management at launch./strong/p pSGX Securities has officially welcomed the Lion-OCBC Securities APAC Financial Dividend Plus ETF, an ETF with S$47m in assets under management (AUM) that tracks the region’s financial sector. This is reportedly the world’s first ETF tracking the APAC financial sector.

Read more »

Singapore leads APAC in AI adoption in the workplaceThe study indicates that 45% of Singaporean businesses already use AI in their daily functions, and another 38% plan to adopt AI technologies soon

Singapore leads APAC in AI adoption in the workplaceThe study indicates that 45% of Singaporean businesses already use AI in their daily functions, and another 38% plan to adopt AI technologies soon

Read more »

Singapore leads APAC in workplace AI integrationpstrongFour in 10 firms are already using AI in their operations./strong/p pSingapore leads the Asia-Pacific (APAC) region in AI adoption in the workplace, with 45% of businesses already using AI in their operations and 38% planning to adopt it soon, PERSOLKELLY reported.

Singapore leads APAC in workplace AI integrationpstrongFour in 10 firms are already using AI in their operations./strong/p pSingapore leads the Asia-Pacific (APAC) region in AI adoption in the workplace, with 45% of businesses already using AI in their operations and 38% planning to adopt it soon, PERSOLKELLY reported.

Read more »

Singapore’s outbound real estate investments in APAC dip in Q1: JLLpemCautious sentiment and pricing uncertainties dampen cross-border activity./em/p pSingapore’s cross-border investments in Asia Pacific commercial real estate dropped to under US$400m in the first quarter, tracking a regional downtrend, according to JLL.

Singapore’s outbound real estate investments in APAC dip in Q1: JLLpemCautious sentiment and pricing uncertainties dampen cross-border activity./em/p pSingapore’s cross-border investments in Asia Pacific commercial real estate dropped to under US$400m in the first quarter, tracking a regional downtrend, according to JLL.

Read more »

AIMS APAC REIT distribution per unit slips 5.9% YoY in FY2024pstrongOn the other hand, net property income grew 6.9% YoY./strong/p pAIMS APAC REIT Management Limited said distribution per unit for fiscal year 2024 (FY 2024) ending 31 March declined 5.9% to $9.36 from the previous year’s $9.94.

AIMS APAC REIT distribution per unit slips 5.9% YoY in FY2024pstrongOn the other hand, net property income grew 6.9% YoY./strong/p pAIMS APAC REIT Management Limited said distribution per unit for fiscal year 2024 (FY 2024) ending 31 March declined 5.9% to $9.36 from the previous year’s $9.94.

Read more »

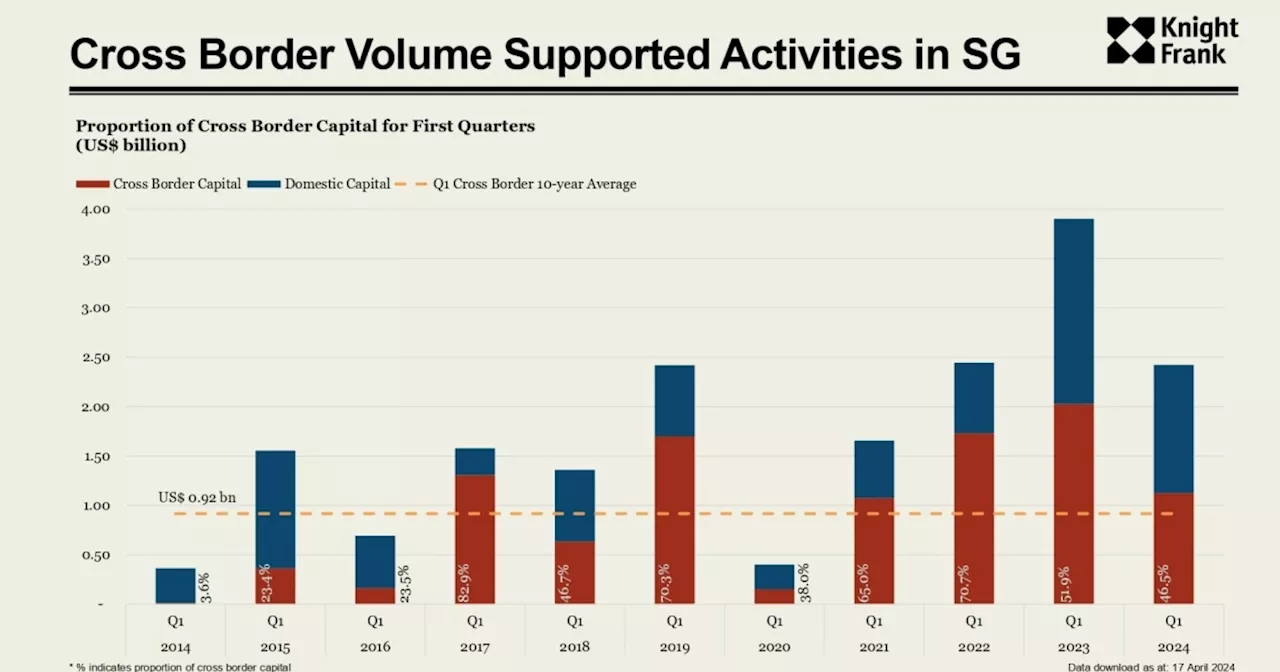

Singapore leads APAC in attracting cross-border capitalpstrongOverseas investments made up 45.6% of Singapore's capital in 1Q24./strong/p pSingapore received the highest portion of cross-border capital in Asia-Pacific, receiving US$906m from institutional investors./p pKnight Frank data revealed that overseas investments constituted 45.6% of Singapore's total capital in 1Q24.

Singapore leads APAC in attracting cross-border capitalpstrongOverseas investments made up 45.6% of Singapore's capital in 1Q24./strong/p pSingapore received the highest portion of cross-border capital in Asia-Pacific, receiving US$906m from institutional investors./p pKnight Frank data revealed that overseas investments constituted 45.6% of Singapore's total capital in 1Q24.

Read more »