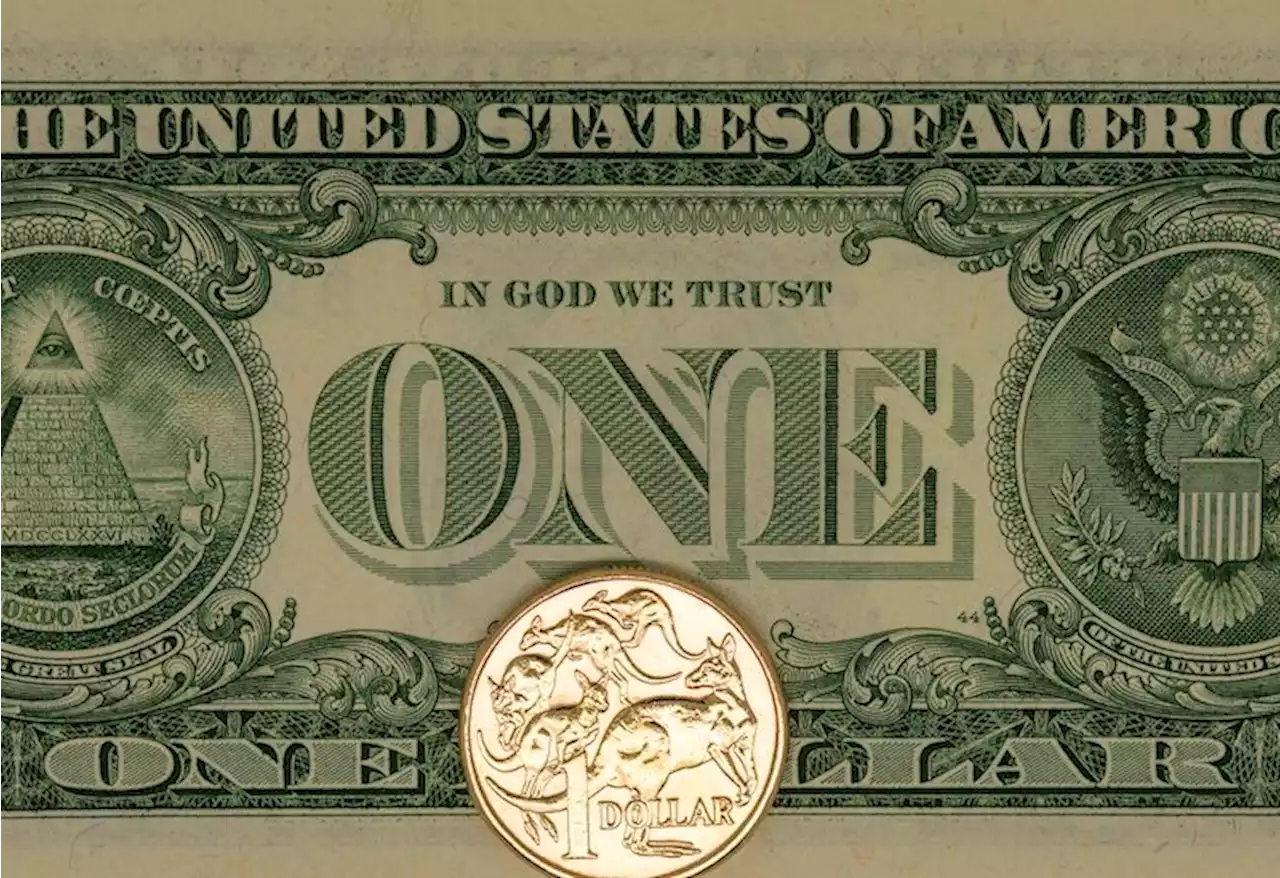

AUD/USD stands on slippery grounds near 0.6430 as it renews the Year-To-Date (YTD) low during the seven-day losing streak early Wednesday. In doing so

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

AUD/USD Price Analysis: Seems vulnerable near YTD low, bearish double-top breakdown in playAUD/USD Price Analysis: Seems vulnerable near YTD low, bearish double-top breakdown in play – by hareshmenghani AUDUSD China Fed Technical Analysis Currencies

AUD/USD Price Analysis: Seems vulnerable near YTD low, bearish double-top breakdown in playAUD/USD Price Analysis: Seems vulnerable near YTD low, bearish double-top breakdown in play – by hareshmenghani AUDUSD China Fed Technical Analysis Currencies

Read more »

GBP/JPY Price Analysis: Strikes YTD high, but potential intervention by Japanese authorities loomGBP/JPY Price Analysis: Striks YTD high, but potential intervention by Japanese authorities loom – by christianborjon GBPJPY Currencies Crosses Technical Analysis

GBP/JPY Price Analysis: Strikes YTD high, but potential intervention by Japanese authorities loomGBP/JPY Price Analysis: Striks YTD high, but potential intervention by Japanese authorities loom – by christianborjon GBPJPY Currencies Crosses Technical Analysis

Read more »

When is the RBA Minutes, Australia Wage Price Index and how could they affect AUD/USD?Early Tuesday morning in Asia, at 01:30 GMT, the Reserve Bank of Australia (RBA) will release its minutes of the latest monetary policy meeting held i

When is the RBA Minutes, Australia Wage Price Index and how could they affect AUD/USD?Early Tuesday morning in Asia, at 01:30 GMT, the Reserve Bank of Australia (RBA) will release its minutes of the latest monetary policy meeting held i

Read more »

China’s July Retail Sales and Industrial Production ease, keeping AUD/USD bears on the lookoutChina’s July Retail Sales and Industrial Output slide below market forecasts and priors – by anilpanchal7 China IndustrialProduction RetailSales RiskAversion Macroeconomics

China’s July Retail Sales and Industrial Production ease, keeping AUD/USD bears on the lookoutChina’s July Retail Sales and Industrial Output slide below market forecasts and priors – by anilpanchal7 China IndustrialProduction RetailSales RiskAversion Macroeconomics

Read more »

AUD/USD Forecast: More losses likely while under 0.6500The AUD/USD pair bottomed on Monday at 0.6454, reaching the lowest intraday level since November. It then rebounded toward 0.6500. However, the pair r

AUD/USD Forecast: More losses likely while under 0.6500The AUD/USD pair bottomed on Monday at 0.6454, reaching the lowest intraday level since November. It then rebounded toward 0.6500. However, the pair r

Read more »

AUD/USD stalls nearby 0.6500 amid UST yield surge, China’s real estate concernsAUD/USD pares some of its earlier losses as US Treasury bond yields turned flat after registering solid gains, but a US 3-month bills auction increase

AUD/USD stalls nearby 0.6500 amid UST yield surge, China’s real estate concernsAUD/USD pares some of its earlier losses as US Treasury bond yields turned flat after registering solid gains, but a US 3-month bills auction increase

Read more »