There are signs that bank profitability could be waning.

The banking industry may be resilient, but it is showing signs of stress, according to a report from the Federal Deposit Insurance Corp. on Thursday.

There are signs that profitability could be waning. Initially, the Federal Reserve’s push to raise interest rates over the last year and a half was a boon for banks, as it allowed them to earn more on interest-earning assets. But eventually, higher rates mean that banks feel pressure to pay their depositors, and they see other funding costs creep up as well. Accordingly, net interest margin at banks fell three basis points to 3.28% in the June quarter from the first three months of the year.

This caused problems within the sector this spring when depositors, in search of higher yields, yanked money from some banks, forcing them to crystallize those losses. While deposit outflows continued for the fifth straight quarter, the pace “moderated substantially” from the first three months of the year, FDIC Chairman Martin Gruenberg said Thursday.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

FDIC kicks off $33 billion sale of seized assets from Signature BankFinancing is being offered to drum up interest in a roughly $33 billion pool of commercial-real-estate loans seized from Signature Bank.

FDIC kicks off $33 billion sale of seized assets from Signature BankFinancing is being offered to drum up interest in a roughly $33 billion pool of commercial-real-estate loans seized from Signature Bank.

Read more »

FDIC to retain ownership of home loans that faced uncertaintyThe Federal Deposit Insurance Corp. has found a way forward for the $15 billion worth of affordable-housing assets it took over from failed Signature Bank.

FDIC to retain ownership of home loans that faced uncertaintyThe Federal Deposit Insurance Corp. has found a way forward for the $15 billion worth of affordable-housing assets it took over from failed Signature Bank.

Read more »

U.S. bank profits flat after accounting for failed bank acquisitions: FDIC By ReutersU.S. bank profits flat after accounting for failed bank acquisitions: FDIC

Read more »

FDIC says inflation, interest rates and geopolitical uncertainty are among ‘matters of continued supervisory attention’Bank earnings fell 11.3% in the second quarter due to the impact of three bank failures, and they will continue to face headwinds from commercial real...

FDIC says inflation, interest rates and geopolitical uncertainty are among ‘matters of continued supervisory attention’Bank earnings fell 11.3% in the second quarter due to the impact of three bank failures, and they will continue to face headwinds from commercial real...

Read more »

Bank earnings fell 11.3% in second quarter from prior quarter after impact of three failed banks: FDICThe failure of three banks in early 2023 pushed bank earnings down 11.3% in the second quarter compared to the prior quarter, according to the Federal...

Bank earnings fell 11.3% in second quarter from prior quarter after impact of three failed banks: FDICThe failure of three banks in early 2023 pushed bank earnings down 11.3% in the second quarter compared to the prior quarter, according to the Federal...

Read more »

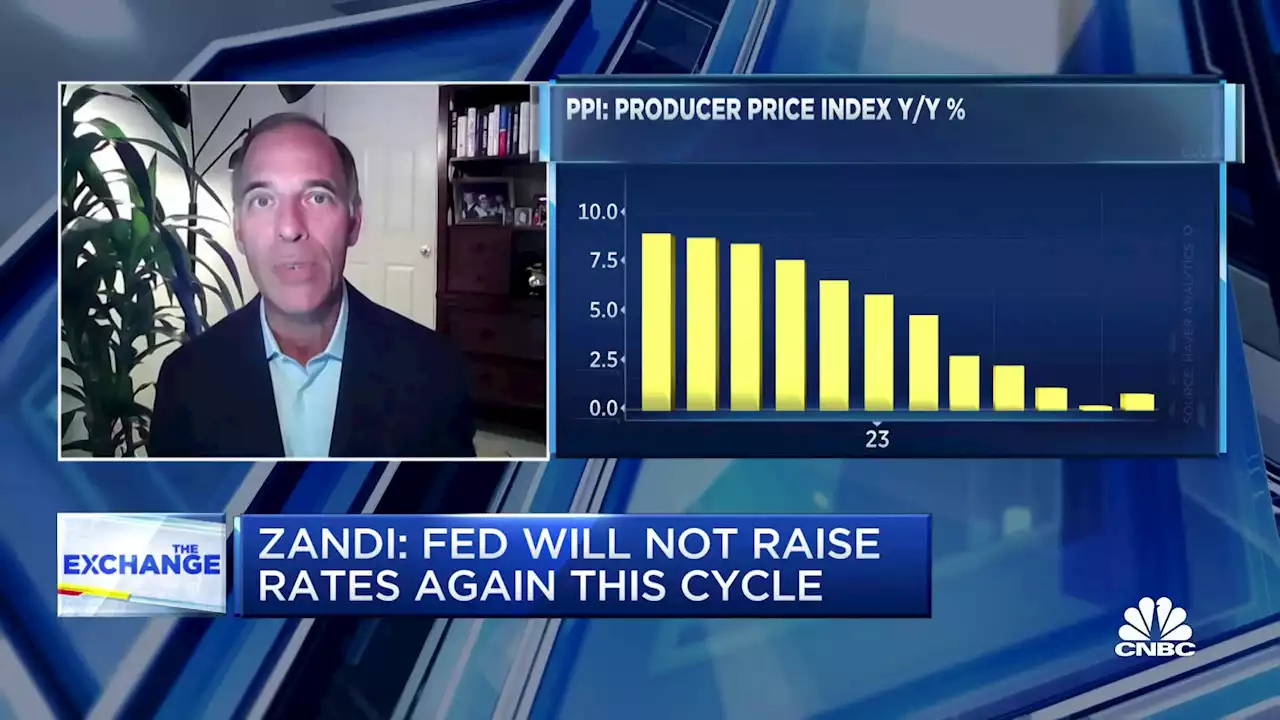

Recession looks unlikely if consumers remain resilient, says Moody's Mark ZandiCNBC's Steve Liesman and Mark Zandi, Moody Analytics chief economist, join 'The Exchange' to discuss the Fed and economy.

Recession looks unlikely if consumers remain resilient, says Moody's Mark ZandiCNBC's Steve Liesman and Mark Zandi, Moody Analytics chief economist, join 'The Exchange' to discuss the Fed and economy.

Read more »