The BRICS intergovernmental organization has doubled in size and is preparing for its next summit in 2024. The organization, which unites Brazil, Russia, India, China, and South Africa, welcomed Egypt, Ethiopia, Iran, and the United Arab Emirates into its fold. The upcoming summit will be held in the city of Kazan from October 22 to 24, 2024.

Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage of important industry events and analyses of market-affecting developments.

Millman said the primary target audience for stories pushing the BRICS narratives of de-dollarization, SWIFT alternatives, growth rates, investment capital gains, and proliferating millionaires is neither current BRICS members nor the West, but the unaligned countries who belong to neither camp. “When you consider how countries print money, how central banks are constantly growing the money supply, one of gold's calling cards is the stock-to-flow ratio,” Millman said. “The existing stock of gold is so massive compared to the amount of new gold that is mined each year, but that level of mined gold is very consistent. It tends to be close to 1%, so there's a one percent growth in the gold supply each year.

“If you look at the inclusion in the BRICS of the additional members, no matter which economies we're talking about, we are still talking about emerging economies,” Ahmad said. “Emerging markets carry a risk. They're not safe havens. You never know what might happen next. So that's still a disadvantage with the BRICS; despite its long-term potential, they are volatile.

“I wouldn't underestimate the possibility of the United States and the rest of the West coming to some kind of adjustment to the system,” he said. “I'm not sure exactly what it would look like, but I certainly don't think that Europe and North America would take that development lying down. I think there would be some response, there would be some kind of tit-for-tat or back and forth, that would make this a very long process.

Ahmad said that notwithstanding his long-term belief in the BRICS, the bloc is not going to put forth a contending currency anytime soon. Button said that even the sum total of the best non-USD international debt that already exists is unable to compete in terms of liquidity, and this includes the debt of the rest of the world’s developed economies, whereas the BRICS members are developing economies with far riskier sovereign bonds.

“At one point it was closing the gap,” Ahmad noted. “But an issue is that there was no standardization of capital markets in terms of fixed income. You could buy a German bond at one price, but then a Greek bond at a different price. Obviously, if you follow the history of the European Union, a Greek bond carried a certain higher risk at some point over the past.”

“At the moment, it's all completely make-believe,” Ahmad said. “I'm not saying something might not be possible, and I'm definitely not saying that the dollar does not need a contender.

And it’s not as if all this growth is happening independently and the U.S. dollar has kept up, so much as that the growth is happening on the backbone of the greenback. “That's why I talk about the importance of standardization of products,” he said. “Because the dollar is a standard. It's set the standard.”

If the countries of the world begin to coalesce into separate currency camps with gold at their core, Millman said the members forming Team USA will be a foregone conclusion. “This time around, I think Europe is much more closely aligned with the U.S.,” he said. “I would also say Canada is much more closely aligned with the U.S. in that regard, given the fact that their central bank doesn't own any gold anymore.

Millman said that if this fundamental realignment between Europe and North America comes to pass, it will pose a formidable challenge to the growth prospects of the BRICS. “When you add that whole bloc together… I don't want to minimize the potential importance of BRICS and any of those non-Western-aligned countries, the amount of resources that they can bring to bear is significant,” he said.

Millman said that if the existing financial order undergoes this kind of bifurcation, he believes North America and Europe will have the upper hand, including in precious metals. “Even if it goes to some sort of gold-backed system of trade, as long as the United States has the gold it says it does, it's just very hard to imagine that they would not have the leading position in whatever replacement system comes along.

The answer appears to be yes. The bloc seems intent on carving out its own niche in international trade and finance, one which will provide an economic and financial framework firewalled off from U.S. coercion and control. If the financial system splits in two, America may still be the strongest side by any objective analysis, but countries with objectives that can only be achieved outside the U.S. and European-led international order may see no alternative to banding together under the China-led BRICS, trading“They want a trading bloc that is liberal markets and no chance of sanctions based on human rights,” Button said. “That's a seductive sell.

“They often use rhetoric and make the point that they want to export Chinese style of government, of economic organization, to the rest of the world, following the same playbook that allowed the West and the United States to become such a big player on the global stage,” he said. “It's almost the exact same process, just replacing neoliberal economics with this kind of Chinese-style mixed economy of central planning plus certain free market principles.

Millman noted that China is the world's biggest producer of gold. “But not all of that production is within mainland China,” he said. “Some significant portion of it is Chinese-owned mines in foreign countries. I think that's an obvious part of their strategy.

Under this scenario, China would hold all the cards, and could speak to the BRICS nations and much of the developing world from the same position that the U.S. has often spoken to the current international order: We control your trade by being your market. We control your resources, either through direct ownership or long-term lease agreements. You've got deep debt obligations to us through the New Development Bank, and Belt-and-Road.

BRICS Intergovernmental Organization Summit Expansion Brazil Russia India China South Africa Egypt Ethiopia Iran United Arab Emirates Kazan

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Blue Jays looking for more in 2024 after third wild-card sweep in four yearsThere was no roster makeover, blockbuster trade or eye-popping free-agent signing for the Toronto Blue Jays this past off-season. The club is essentially running it back with virtually the same core as last year and hoping the bats return to form.

Blue Jays looking for more in 2024 after third wild-card sweep in four yearsThere was no roster makeover, blockbuster trade or eye-popping free-agent signing for the Toronto Blue Jays this past off-season. The club is essentially running it back with virtually the same core as last year and hoping the bats return to form.

Read more »

Ukraine, Georgia, Poland are going to UEFA Euro 2024 after late drama in qualifying playoffsUkraine found another late winning goal in another comeback win. Georgia and Poland held their nerve in penalty shootouts. All are going to the European Championship.

Ukraine, Georgia, Poland are going to UEFA Euro 2024 after late drama in qualifying playoffsUkraine found another late winning goal in another comeback win. Georgia and Poland held their nerve in penalty shootouts. All are going to the European Championship.

Read more »

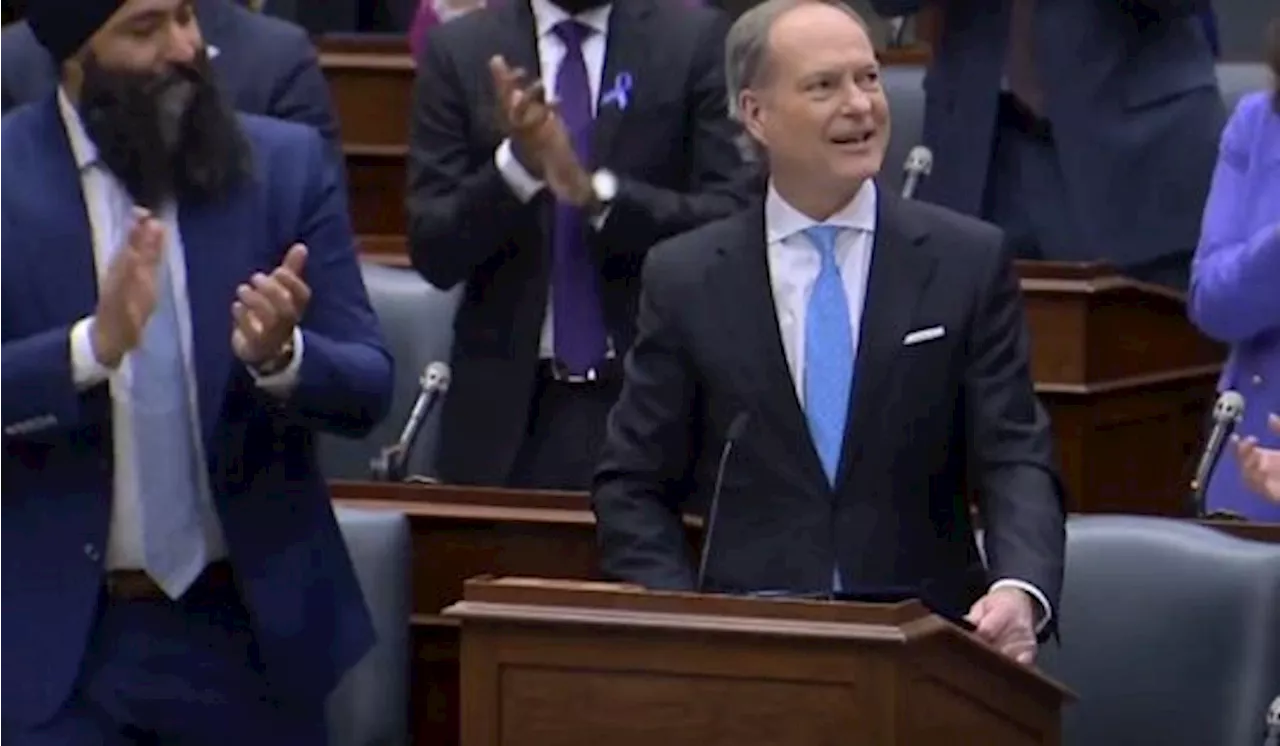

Ontario unveils 2024 budgetOntario Finance Minister Peter Bethlenfalvy is acknowledging the challenging economic times, saying life has rarely been this expensive, but the budget he prese

Ontario unveils 2024 budgetOntario Finance Minister Peter Bethlenfalvy is acknowledging the challenging economic times, saying life has rarely been this expensive, but the budget he prese

Read more »

What’s open and closed for the Easter 2024 long weekend in Durham RegionThe usual closures are happening in Durham Region this Easter long weekend. Essentials Most banks will be closed on Good Friday, but open on Monday. Ca

What’s open and closed for the Easter 2024 long weekend in Durham RegionThe usual closures are happening in Durham Region this Easter long weekend. Essentials Most banks will be closed on Good Friday, but open on Monday. Ca

Read more »

Ontario promises auto insurance changes in 2024 budgetThe Ontario government will move forward with 'auto insurance reforms' as part of its 2024 provincial budget.

Ontario promises auto insurance changes in 2024 budgetThe Ontario government will move forward with 'auto insurance reforms' as part of its 2024 provincial budget.

Read more »

New medical school and helicopters: Here’s what else was in the 2024 Ontario budgetHere are some of the quirkier highlights from the 2024 Ontario budget.

New medical school and helicopters: Here’s what else was in the 2024 Ontario budgetHere are some of the quirkier highlights from the 2024 Ontario budget.

Read more »