Circle's CFO, Jeremy Fox, preached the firm's commitment to transparency in an attempt to dissipate insecurities. According to his post, the company's business model is based on minimizing risks, not “taking and managing them.”

The chief financial officer said that Circle's business model is to minimize risk, not “taking and managing risk.” He also explained how the firm protects its USD Coin reserves, emphasizing that Circle does not own these assets and that they are 100%t owned by USDC holders in segregated accounts labeled"for the benefit of USDC holders." Fox wrote:

"Circle is not allowed to use the USDC reserves for any other purpose. Unlike a bank or an exchange or an unregulated institution, we cannot lend them out, we cannot borrow against them, and we cannot use them to pay our bills." As a result, in extreme situations like bankruptcy, the USD Coin is purportedly still redeemable at face value. Also, the USDC reserves are completely disconnected from Circle's other activities, minimizing the risk of them being used to cover other losses.

Circle CEO Jeremy Allaire also recently provided documentation to demonstrate that the stablecoin has sufficient liquidity. He published a lengthy Twitter thread with papers to increase public confidence and transparency in the firm. The thread followed rumors that Circle had lost billions of dollars by offering wilder incentive programs to several banks, including Silvergate and Signature, to convert cash deposits into the USDC stablecoin.

Some firms have faced liquidity difficulties as a result of the bear market, making investors fearful that more will join them in the near future. Three Arrows Capital, once a prominent cryptocurrency investment firm,

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

XRP Lawsuit: Court's Decision on Hinman Emails to Arrive Soon, Jeremy HoganICYMI: according to Jeremy Hogan, the court will rule on Hinman emails this week SEC Ripple XRP $XRP XRPnews XRPArmy

XRP Lawsuit: Court's Decision on Hinman Emails to Arrive Soon, Jeremy HoganICYMI: according to Jeremy Hogan, the court will rule on Hinman emails this week SEC Ripple XRP $XRP XRPnews XRPArmy

Read more »

Circle's USDC on track to topple Tether USDT as the top stablecoin in 2022The battle for stablecoin supremacy is getting heated. The growth of Circle's stablecoin USDC in the last two months compared to its $66-billion rival giant USDT is nothing short of spectacular. USDC's market capitalization has grown by 8.27% since May.

Circle's USDC on track to topple Tether USDT as the top stablecoin in 2022The battle for stablecoin supremacy is getting heated. The growth of Circle's stablecoin USDC in the last two months compared to its $66-billion rival giant USDT is nothing short of spectacular. USDC's market capitalization has grown by 8.27% since May.

Read more »

‘Korean Side Bangs’ Are Trending Like Crazy for Those Who Want ‘Bangs with Benefits’The look of a bang with less commitment.

‘Korean Side Bangs’ Are Trending Like Crazy for Those Who Want ‘Bangs with Benefits’The look of a bang with less commitment.

Read more »

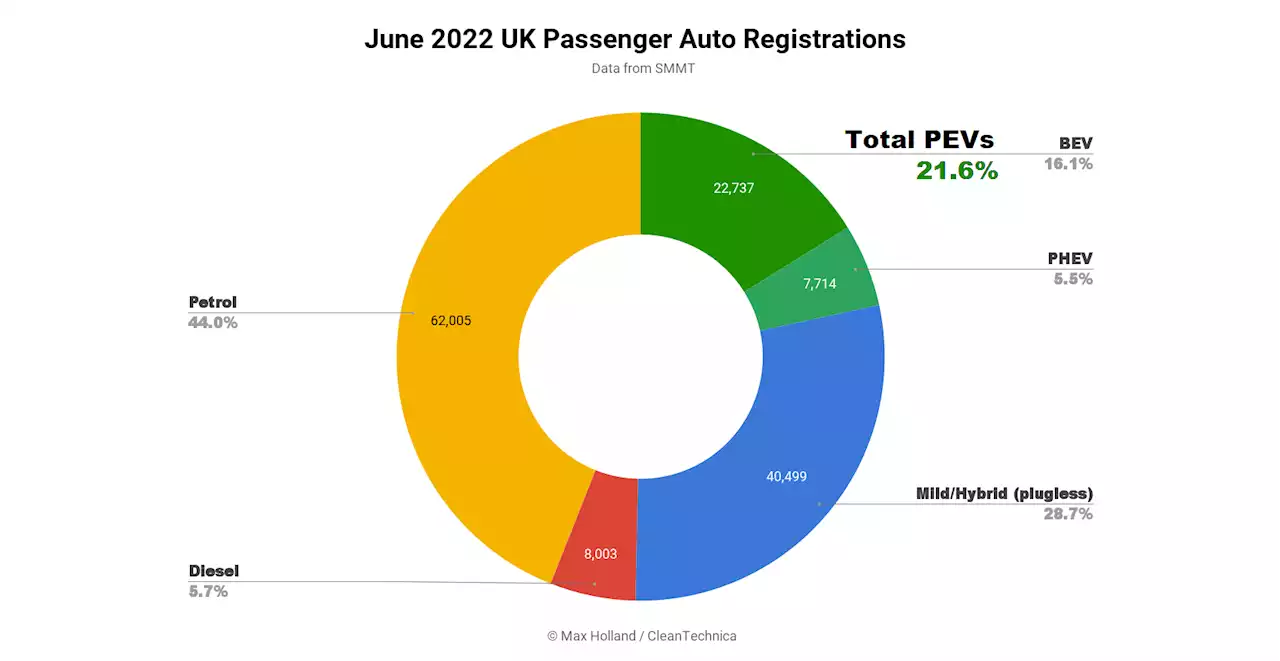

UK Plugin EV Share At 22%, Tesla Model Y Overall Runner UpJune saw plugin electric vehicles take 21.6% market share in the UK, up from 17.2% YoY.

UK Plugin EV Share At 22%, Tesla Model Y Overall Runner UpJune saw plugin electric vehicles take 21.6% market share in the UK, up from 17.2% YoY.

Read more »

European Stocks Head for Higher Open as Global Markets Look for Gains After RoutEuropean stocks are expected to open higher on Tuesday as global markets look to cement gains after a bruising week for stocks last week.

European Stocks Head for Higher Open as Global Markets Look for Gains After RoutEuropean stocks are expected to open higher on Tuesday as global markets look to cement gains after a bruising week for stocks last week.

Read more »

Morning Bid: Hoping for a calmer H2? Forget itA look at the day ahead in markets from Saikat Chatterjee.

Morning Bid: Hoping for a calmer H2? Forget itA look at the day ahead in markets from Saikat Chatterjee.

Read more »