An overview of the risks of price slippage in DeFi and how to mitigate them [AD]

Price slippage is a constant risk in trading on centralized exchanges and decentralized exchanges alike. It occurs when a trader’s order is executed at a different price than the one intended. It can happen due to high volatility, low liquidity or delays in order execution, resulting in a noticeable difference between the expected and actual transaction price.

The depth of an order book is defined by the quantity of buy and sell orders at different price levels. Market depth is a key indicator of liquidity on any platform. Thus, the greater the market depth, the lower the chance of price slippage, thanks to the balance between buy and sell orders. Since order books are managed by centralized entities, DEXs don’t have these at all. Instead, they employ the model, which implies pre-funded pools for each cryptocurrency pair to cover both sides of trades. The liquidity pools are supplied by liquidity providers, who get incentivized to lock an equal value of both cryptocurrencies of a pair. The trading fees on the DEX are distributed to all liquidity providers, who take the role of market makers.

To reduce the risk of price slippage, DEXs have to ensure high liquidity in their pools. There is no DEX capable of competing with large CEXs in terms of liquidity, but DEX aggregators can do the trick. DEX aggregators ensure a high degree of liquidity by having access to multiple DEXs at once. Features like order splitting and order routing can further reduce the risk of price slippage. is a relevant example of a DEX aggregator.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

PawSwap (PAW) DEX to Start Testing on Shiba Inu's Shibarium BetaNow that Shibarium is to be launched this week, PawSwap DEX developers are eager to begin testing on Layer 2 network

PawSwap (PAW) DEX to Start Testing on Shiba Inu's Shibarium BetaNow that Shibarium is to be launched this week, PawSwap DEX developers are eager to begin testing on Layer 2 network

Read more »

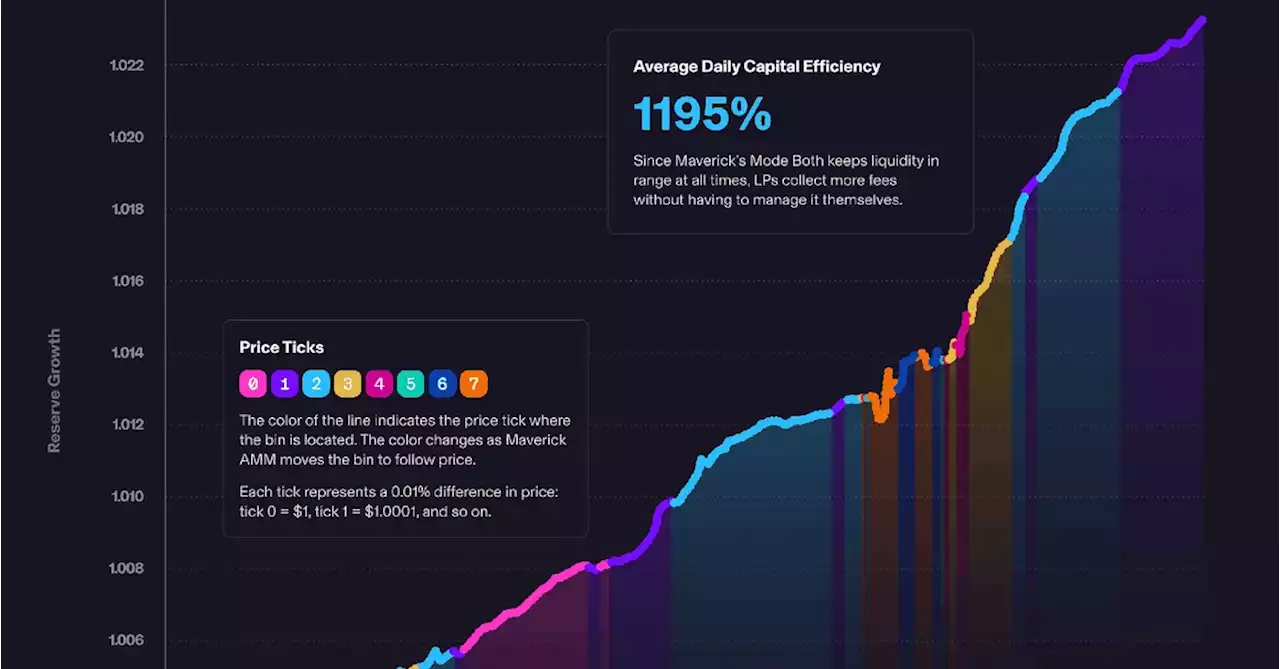

Maverick Protocol DEX launches with Lido integration to compete with UniswapThe protocol increases the capital efficiency for liquidity providers with automatic trading modes, Maverick CTO Bob Baxley told The Block.

Maverick Protocol DEX launches with Lido integration to compete with UniswapThe protocol increases the capital efficiency for liquidity providers with automatic trading modes, Maverick CTO Bob Baxley told The Block.

Read more »

Kwenta DEX Lures Traders to Capture Bitcoin, Ether Returns Regardless of DirectionCrypto traders can earn over 1% in a market-neutral strategy on Kwenta_io, whose $KWENTA tokens have surged strongly in the past few weeks. By shauryamalwa

Kwenta DEX Lures Traders to Capture Bitcoin, Ether Returns Regardless of DirectionCrypto traders can earn over 1% in a market-neutral strategy on Kwenta_io, whose $KWENTA tokens have surged strongly in the past few weeks. By shauryamalwa

Read more »

DeFi Protocol Maverick Unveils UniSwap Rival Decentralized Exchange on Ethereum.mavprotocol developed a novel automated market maker (AMM) smart contract that promises higher capital efficiency, in other words more profit, for liquidity providers than top decentralized exchange Uniswap. sndr_krisztian reports

DeFi Protocol Maverick Unveils UniSwap Rival Decentralized Exchange on Ethereum.mavprotocol developed a novel automated market maker (AMM) smart contract that promises higher capital efficiency, in other words more profit, for liquidity providers than top decentralized exchange Uniswap. sndr_krisztian reports

Read more »

Cardano (ADA) DeFi Hits ATH in Total Value Locked: DetailsCardano's DeFi TVL has been growing consistently for over month to hit new ATH

Cardano (ADA) DeFi Hits ATH in Total Value Locked: DetailsCardano's DeFi TVL has been growing consistently for over month to hit new ATH

Read more »