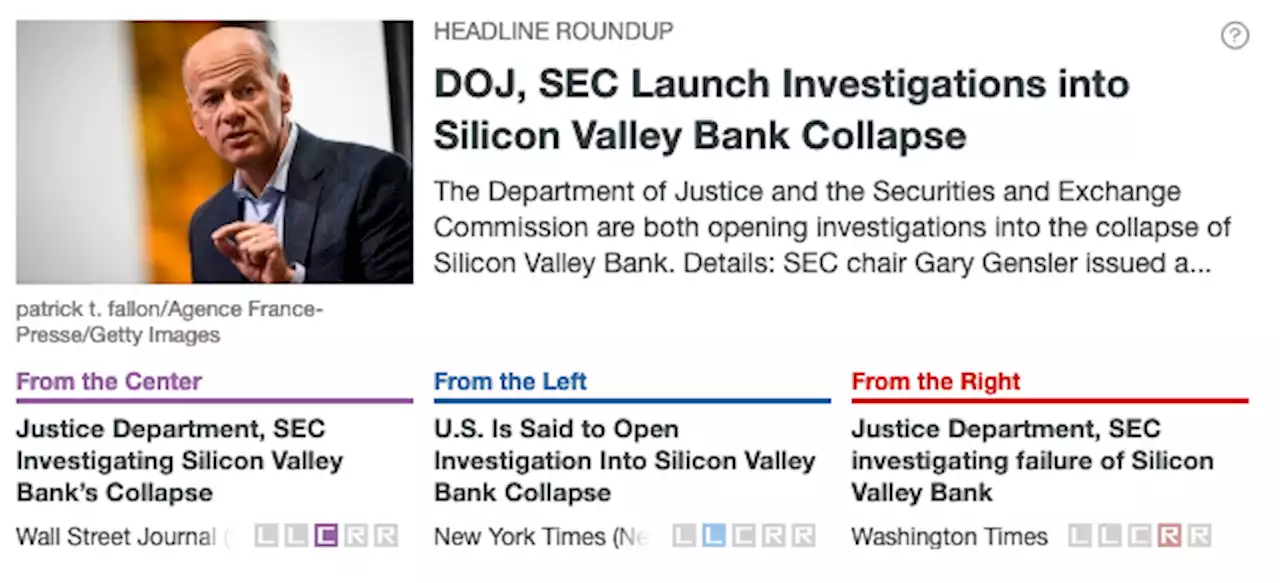

The Department of Justice and the Securities and Exchange Commission are both investigating the collapse of Silicon Valley Bank. See potential bias and similarities in coverage from WSJ, nytimes, WashTimes:

SEC chair Gary Gensler issued a statement Sunday stating, “without speaking to any individual entity or person, we will investigate and bring enforcement actions if we find violations of the federal securities laws.” Both investigations are in the initial stages, and the focus of the probes is not yet clear.

Outlets across the spectrum are speculating the focus could include stock trades made by Silicon Valley Bank executives in the weeks leading up to the collapse.Last week, the FDIC took control of Silicon Valley Bank, a popular lender for tech startups, after customers tried to withdraw $42 billion on Thursday.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

![]() Bank regulators seize Silicon Valley Bank in largest bank failure since the Great RecessionThe bank failed after depositors — mostly technology workers and venture capital-backed companies — began withdrawing their money creating a run on the bank.

Bank regulators seize Silicon Valley Bank in largest bank failure since the Great RecessionThe bank failed after depositors — mostly technology workers and venture capital-backed companies — began withdrawing their money creating a run on the bank.

Read more »

Can the Government Contain a Banking Crisis? - The Journal. - WSJ PodcastsWhen Silicon Valley Bank imploded last week, it was the second biggest bank failure in U.S. history. Then, over the weekend, another bank, Signature Bank, was also taken over by the government. WSJ financial editor Charles Forelle explains what kicked off this banking crisis and how the government is scrambling to contain it. Further Reading: - How Silicon Valley Turned on Silicon Valley Bank - Silicon Valley Bank Closed by Regulators, FDIC Takes Control - Were SVB and Signature Bank Just Bailed Out by the U.S. Government?

Can the Government Contain a Banking Crisis? - The Journal. - WSJ PodcastsWhen Silicon Valley Bank imploded last week, it was the second biggest bank failure in U.S. history. Then, over the weekend, another bank, Signature Bank, was also taken over by the government. WSJ financial editor Charles Forelle explains what kicked off this banking crisis and how the government is scrambling to contain it. Further Reading: - How Silicon Valley Turned on Silicon Valley Bank - Silicon Valley Bank Closed by Regulators, FDIC Takes Control - Were SVB and Signature Bank Just Bailed Out by the U.S. Government?

Read more »

Crypto-friendly Signature Bank shut down by regulators, after collapses of Silicon Valley Bank, SilvergateState authorities closed Signature Bank Sunday, after Silicon Valley Bank was shut down by regulators on Friday in the biggest bank failure since the 2008...

Crypto-friendly Signature Bank shut down by regulators, after collapses of Silicon Valley Bank, SilvergateState authorities closed Signature Bank Sunday, after Silicon Valley Bank was shut down by regulators on Friday in the biggest bank failure since the 2008...

Read more »

![]() U.S. Treasury says Silicon Valley Bank, Signature Bank 'not being bailed out'New policies adopted on Sunday by U.S. banking regulators will 'wipe out' equity and bondholders in Silicon Valley Bank and Signature Bank of New York while protecting all customer deposits, a senior U.S. Treasury official said.

U.S. Treasury says Silicon Valley Bank, Signature Bank 'not being bailed out'New policies adopted on Sunday by U.S. banking regulators will 'wipe out' equity and bondholders in Silicon Valley Bank and Signature Bank of New York while protecting all customer deposits, a senior U.S. Treasury official said.

Read more »

![]() Second Bank Shuttered by Regulators After Silicon Valley Bank’s CollapseSignature bank, a titanic figure in the crypto industry, was shut down by New York’s state chartering authority Sunday. It was the second U.S. bank to shutter in the past week.

Second Bank Shuttered by Regulators After Silicon Valley Bank’s CollapseSignature bank, a titanic figure in the crypto industry, was shut down by New York’s state chartering authority Sunday. It was the second U.S. bank to shutter in the past week.

Read more »

Regulators close New York's Signature Bank following Silicon Valley Bank collapseThe New York Department of Financial Services announced on Sunday that it has taken possession of Signature Bank and appointed the Federal Deposit Insurance Corporation (FDIC) as the bank's receiver.

Regulators close New York's Signature Bank following Silicon Valley Bank collapseThe New York Department of Financial Services announced on Sunday that it has taken possession of Signature Bank and appointed the Federal Deposit Insurance Corporation (FDIC) as the bank's receiver.

Read more »