SHAH ALAM, March 4 — The Employees’ Provident Fund (EPF) Board expects to obtain optimal returns for shariah savings if its assets are completely separated from conventional...

SHAH ALAM, March 4 — The Employees’ Provident Fund Board expects to obtain optimal returns for shariah savings if its assets are completely separated from conventional savings assets.

“This can ensure that both shariah savings and conventional savings have a more optimal, competitive and sustainable long-term return,” he said at a press conference after the EPF’s financial performance briefing here today. He said the separation allows the EPF to set a percentage limit for each desired investment, and not because investments in shariah savings are not halal.

“So, in terms of the portfolio, we have to be good at balancing it, if one investment portfolio goes down, while the other survives, then we can stabilise ,” he explained. He added that Budget 2023 emphasised efforts to strengthen the recovery and resilience of the country’s economy.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EPF declares 5.35pc dividend for conventional savings, 4.75pc dividend for shariah savings for 2022SHAH ALAM, March 4 — The Employees Provident Fund (EPF) has declared a dividend rate of 5.35 per cent for conventional savings for 2022 with a total payout of RM45.44 billion....

EPF declares 5.35pc dividend for conventional savings, 4.75pc dividend for shariah savings for 2022SHAH ALAM, March 4 — The Employees Provident Fund (EPF) has declared a dividend rate of 5.35 per cent for conventional savings for 2022 with a total payout of RM45.44 billion....

Read more »

EPF declares 5.35pc dividend for conventional, 4.75pc shariah savingsSHAH ALAM: The Employees Provident Fund (EPF) has declared a dividend rate of 5.35 per cent for conventional savings for 2022 with a total payout of RM45.44 billion.

EPF declares 5.35pc dividend for conventional, 4.75pc shariah savingsSHAH ALAM: The Employees Provident Fund (EPF) has declared a dividend rate of 5.35 per cent for conventional savings for 2022 with a total payout of RM45.44 billion.

Read more »

EPF refuses another round of withdrawal, says Bumiputera savings dropped 70pc during pandemicSHAH ALAM, March 4 — The Employees’ Provident Fund (EPF) said today it is not in favour of another round of early withdrawal as many Bumiputera account holders have...

EPF refuses another round of withdrawal, says Bumiputera savings dropped 70pc during pandemicSHAH ALAM, March 4 — The Employees’ Provident Fund (EPF) said today it is not in favour of another round of early withdrawal as many Bumiputera account holders have...

Read more »

EPF withdrawals larger than GDP of some countries, says fund's CEOSHAH ALAM: The RM145.5bil withdrawal of Employees Provident Funds (EPF) was bigger than the individual gross domestic product (GDP) of some 100 countries and territories, says Datuk Seri Amir Hamzah Azizan.

EPF withdrawals larger than GDP of some countries, says fund's CEOSHAH ALAM: The RM145.5bil withdrawal of Employees Provident Funds (EPF) was bigger than the individual gross domestic product (GDP) of some 100 countries and territories, says Datuk Seri Amir Hamzah Azizan.

Read more »

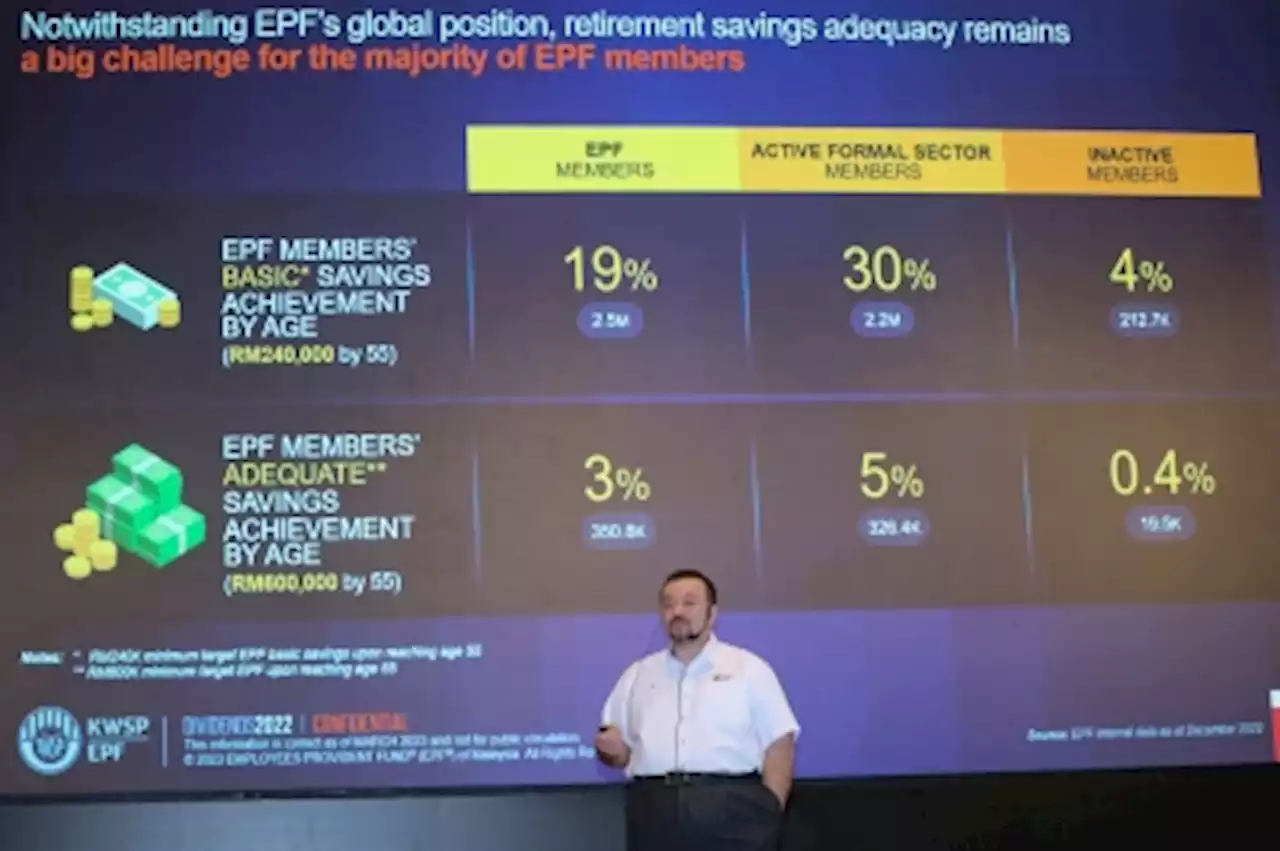

Low wages must be addressed, 81% of active EPF members earn RM5,000 or lessSHAH ALAM: The low wage structure in Malaysia is one of the reasons why there is inadequacy of retirement savings, says the Employees Provident Fund (EPF).

Low wages must be addressed, 81% of active EPF members earn RM5,000 or lessSHAH ALAM: The low wage structure in Malaysia is one of the reasons why there is inadequacy of retirement savings, says the Employees Provident Fund (EPF).

Read more »