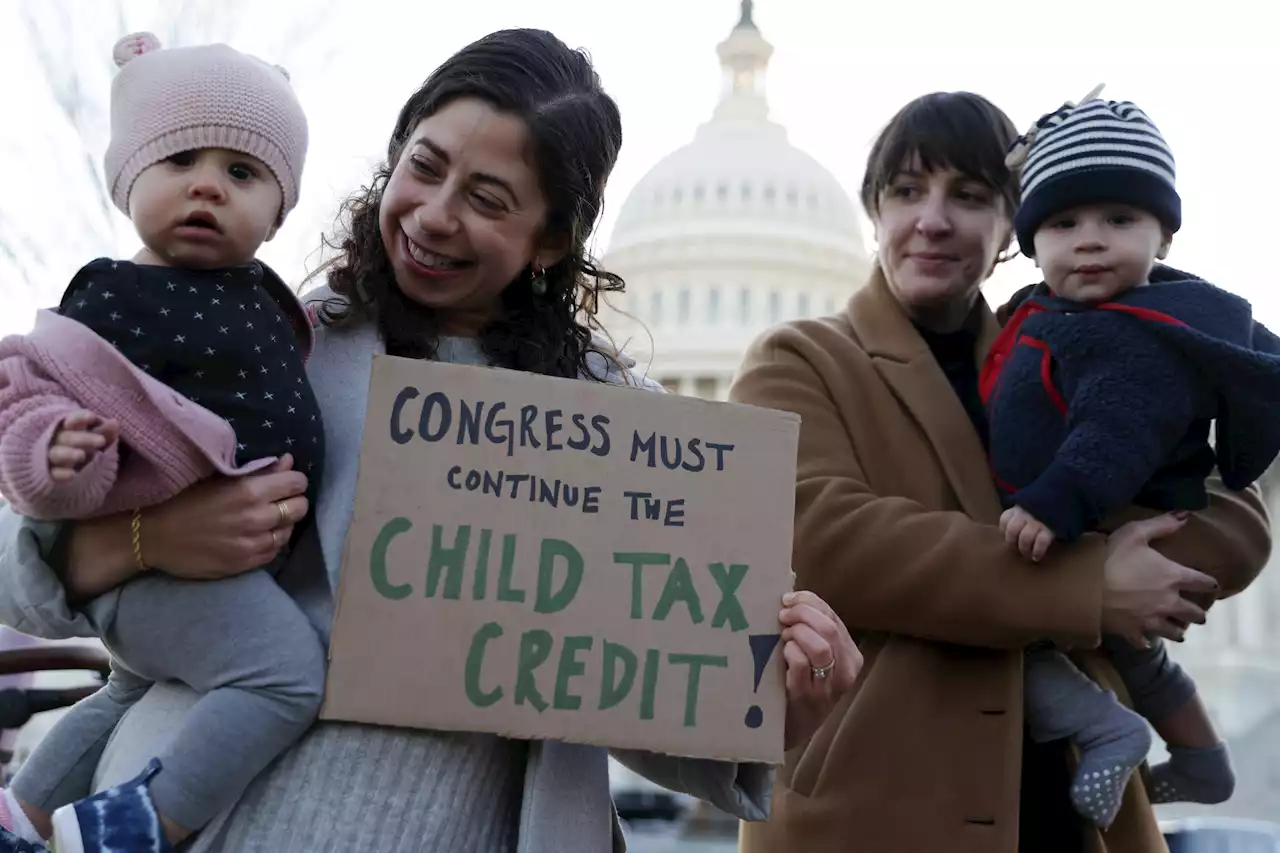

For the first time in half a year, families today are going without a monthly deposit from the child tax credit.

With the final child tax credit payment going out last month, American parents should be looking out for a letter from the IRS. The video explains the key thing feds may be looking for from you.

"You're going to have to learn to adapt," said Roberts, who worked as an auto dealer for five decades."You never really dreamed that everything would all of a sudden explode. You go down and get a package of hamburger and it's $7-8 a pound." Manchin has supported some form of a work requirement for people receiving the payment, out of concern that automatic government aid could cause people to quit their jobs. Yet his primary objection, in a written statement last month, sidestepped that issue as he expressed concerns about inflation and that a one-year extension masked the true costs of a tax credit that could become permanent.

There are separate benefits in terms of improving the outcomes for impoverished children, whose families could not previously access the full tax credit because their earnings were too low. An analysis by the Urban Institute estimated that extending the credit as developed by the Biden administration would cut child poverty by 40%.

Academics who study the tax credit are torn on how a permanent program would affect the economy and child welfare.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Goodbye ‘Godsend': Expiration of Child Tax Credits Hits HomeFor the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Goodbye ‘Godsend': Expiration of Child Tax Credits Hits HomeFor the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Read more »

Child tax credit, stimulus checks could make tax-filing season confusingTax filing will be confusion this year, because many people did not receive all the Stimulus Checks or Child Tax Credit checks they were entitled to in 2021.

Child tax credit, stimulus checks could make tax-filing season confusingTax filing will be confusion this year, because many people did not receive all the Stimulus Checks or Child Tax Credit checks they were entitled to in 2021.

Read more »

What If Congress Made The Child Tax Credit Taxable?I am author of the book 'Caring for Our Parents' and senior fellow at The Urban Institute, where I am affiliated with the Tax Policy Center and the Program on Retirement Policy. I also write a tax and budget policy blog, TaxVox, which you may read at Forbes.com or at http://taxvox.taxpolicycenter.org/ Before joining Urban, I was a senior correspondent in the Washington bureau of Business Week.

What If Congress Made The Child Tax Credit Taxable?I am author of the book 'Caring for Our Parents' and senior fellow at The Urban Institute, where I am affiliated with the Tax Policy Center and the Program on Retirement Policy. I also write a tax and budget policy blog, TaxVox, which you may read at Forbes.com or at http://taxvox.taxpolicycenter.org/ Before joining Urban, I was a senior correspondent in the Washington bureau of Business Week.

Read more »

West Virginians scramble to get by after Manchin kills child tax creditsWithout those monthly checks, 50,000 children in the state the centrist senator represents could sink into deep poverty. MsReads via GuardianUS

West Virginians scramble to get by after Manchin kills child tax creditsWithout those monthly checks, 50,000 children in the state the centrist senator represents could sink into deep poverty. MsReads via GuardianUS

Read more »

You can get up to $8,000 back in tax credit for child-care expenses. Here's what you need to knowThe child and dependent care tax credit, as it's called, was expanded for 2021 and is likely to reach more households.

You can get up to $8,000 back in tax credit for child-care expenses. Here's what you need to knowThe child and dependent care tax credit, as it's called, was expanded for 2021 and is likely to reach more households.

Read more »

Down but not out: Dems plot course for Child Tax Credit as payments endThey may have put it aside for now, but Democrats have not given up on trying to revive their expansion of the Child Tax Credit

Down but not out: Dems plot course for Child Tax Credit as payments endThey may have put it aside for now, but Democrats have not given up on trying to revive their expansion of the Child Tax Credit

Read more »