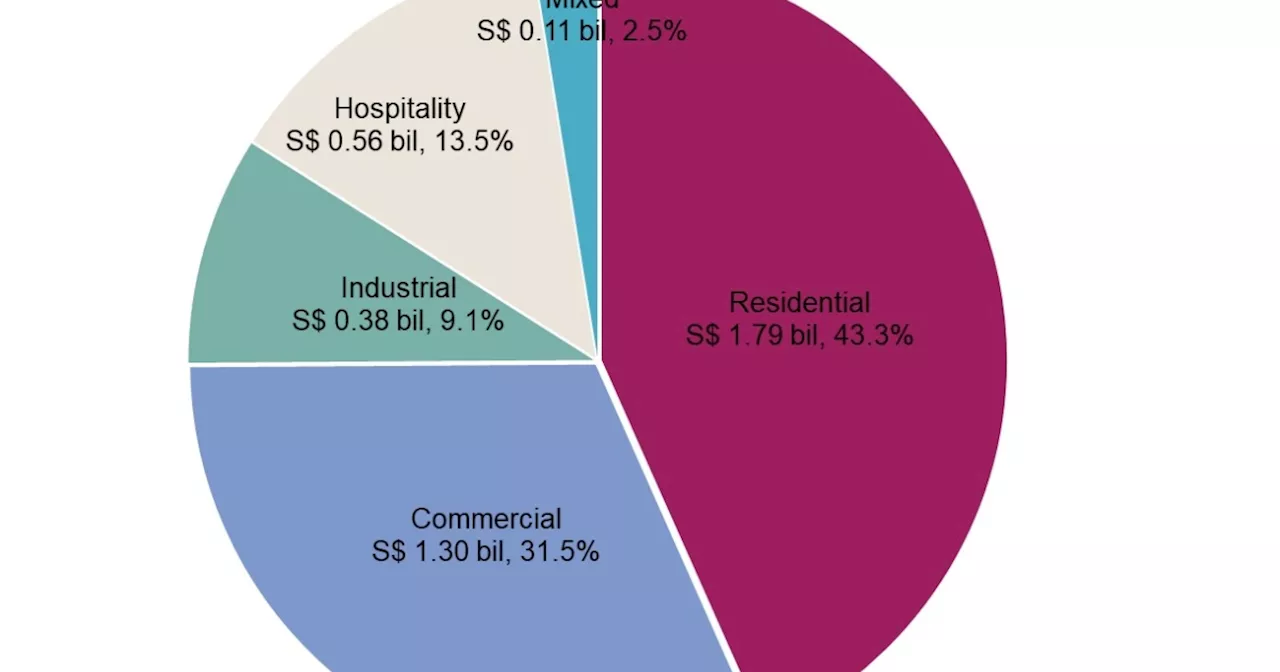

pstrongGLS tenders played a significant role in the investment volume./strong/p pInvestment volume hit fell 34.7% YoY to $4.0b in 1Q24, Colliers reported./p pThe investment volume also fell across segments, with the commercial sector posting the largest decline of 52.7% QoQ.

GLS tenders played a significant role in the investment volume.The investment volume also fell across segments, with the commercial sector posting the largest decline of 52.7% QoQ.

Residential sales also declined 47.6% QoQ to $1.8b. The sector was boosted by the GLS sites, increasing the residential transaction volume by $1.2b. Excluding GLS deals, the retail sector accounted for the biggest chunk of the investment volume at 40%, followed by hospitality and industrial sectors .

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Singapore's GDP Grows 2.7% YoY in 1Q24Singapore's gross domestic product (GDP) grew faster in the first quarter of 2024, increasing by 2.7% year-on-year, according to advance estimates from the Ministry of Trade and Industry (MTI). The goods-producing and services-producing industries both saw expansions, contributing to the overall growth.

Singapore's GDP Grows 2.7% YoY in 1Q24Singapore's gross domestic product (GDP) grew faster in the first quarter of 2024, increasing by 2.7% year-on-year, according to advance estimates from the Ministry of Trade and Industry (MTI). The goods-producing and services-producing industries both saw expansions, contributing to the overall growth.

Read more »

CICT NPI rises 6.3% YoY to $293.7M in 1Q24pstrongGross rental income growth and lower operating expenses drove the uptick./strong/p pCapitaLand Integrated Commercial Trust (CICT) saw its net property income (NPI) increase 6.3% YoY to $293.7m in 1Q24, driven by gross rental income growth and lower operating expenses./p pThe REIT also posted a 2.

CICT NPI rises 6.3% YoY to $293.7M in 1Q24pstrongGross rental income growth and lower operating expenses drove the uptick./strong/p pCapitaLand Integrated Commercial Trust (CICT) saw its net property income (NPI) increase 6.3% YoY to $293.7m in 1Q24, driven by gross rental income growth and lower operating expenses./p pThe REIT also posted a 2.

Read more »

Singapore’s 1Q24 deals plummet 21.1% YoYpstrongIn the whole of APAC, deal volume declined by 12.2% YoY./strong/p pSingapore’s total deals in the first quarter of 2024, including mergers & acquisitions, private equity and venture financing deals, fell 21.1% YoY./p pData from GlobalData showed that deal activity also fell for Asia-Pacific (APAC) by 12.2% YoY to 3,681 deals.

Singapore’s 1Q24 deals plummet 21.1% YoYpstrongIn the whole of APAC, deal volume declined by 12.2% YoY./strong/p pSingapore’s total deals in the first quarter of 2024, including mergers & acquisitions, private equity and venture financing deals, fell 21.1% YoY./p pData from GlobalData showed that deal activity also fell for Asia-Pacific (APAC) by 12.2% YoY to 3,681 deals.

Read more »

Residential sector dominates 1Q24 investment with $1.79BpstrongThe sector's investment sales, however, dropped 48.5% QoQ./strong/p pThe residential sector led investment sales in 1Q24 with $1.79b, accounting for 43.3% of the total transactions for the period./p pWhilst residential emerged as the top-performing sector, its total sales were 48.5% lower quarter-on-quarter.

Residential sector dominates 1Q24 investment with $1.79BpstrongThe sector's investment sales, however, dropped 48.5% QoQ./strong/p pThe residential sector led investment sales in 1Q24 with $1.79b, accounting for 43.3% of the total transactions for the period./p pWhilst residential emerged as the top-performing sector, its total sales were 48.5% lower quarter-on-quarter.

Read more »

Residential sector lead 1Q24 investment salespstrongThe sector accounted for 47.1% of investment deals./strong/p pResidential deals accounted for almost half of investment sales activity in Singapore in 1Q24, data from Knight Frank showed./p pThe residential sector recorded a total sales value of $2b, accounting for 47.1% of investment deals.

Residential sector lead 1Q24 investment salespstrongThe sector accounted for 47.1% of investment deals./strong/p pResidential deals accounted for almost half of investment sales activity in Singapore in 1Q24, data from Knight Frank showed./p pThe residential sector recorded a total sales value of $2b, accounting for 47.1% of investment deals.

Read more »

Sabana Industrial REIT's occupancy rate drops to 83% in 1Q24Sabana Industrial Real Estate Investment Trust (REIT) reported a decline in its occupancy rate for the first quarter of 2024 (1Q24) to 83% from 91.2% in the previous quarter (4Q23) due to the repossession of 33 & 35 Penjuru Lane.

Sabana Industrial REIT's occupancy rate drops to 83% in 1Q24Sabana Industrial Real Estate Investment Trust (REIT) reported a decline in its occupancy rate for the first quarter of 2024 (1Q24) to 83% from 91.2% in the previous quarter (4Q23) due to the repossession of 33 & 35 Penjuru Lane.

Read more »