Alta was earlier ordered to cease this service by Oct 17, in the light of the German insurer's offer.

SINGAPORE - Alta Exchange is in early discussions to explore the possibility of relisting Income Insurance shares on its trading platform, a move which could bring relief to close to 16,000 retail shareholders holding 28 million shares of the local insurer.

The exchange is now in talks with Income and local brokerage Phillip Securities, a unit of wealth management firm PhillipCapital, to work towards relisting the shares at a later date. The Straits Times understands that investors expressed interest to Alta about buying some $5 million worth of Income shares following Allianz’s planned offer.Allianz to consider revising Income offer after current deal blocked by Singapore Govt

Mr Michael Ong, an Income shareholder, was hoping for some capital gains from his investment: “Income shares are not listed on the Singapore Exchange. It is difficult to sell them. “The decision not only underscores the intricate balance between financial viability and upholding social missions but also prompts a deeper reflection on the strategic direction and operational resilience of Income,” Mr Tan said on LinkedIn.

“We believe it will be key for a potential acquirer or acquirers to demonstrate that they will address any concerns that the Government or regulators may have around this. We don’t expect this development to affect the market’s competitive dynamics as the proposed acquisition would have only consolidated existing market positions rather than disrupt them,” he said.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

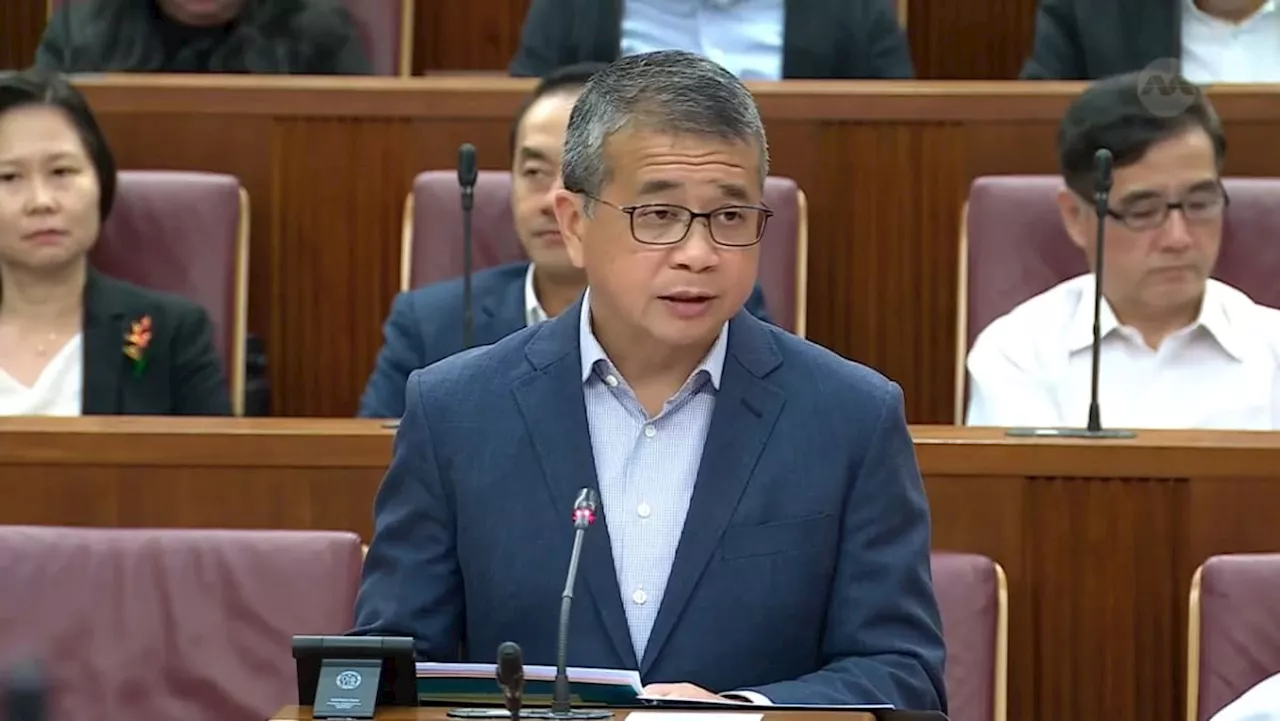

Allianz-Income deal off, ‘not in the public interest’ to proceed in current form: Edwin TongThe scrapping of the deal was announced in Parliament on Oct 14.

Allianz-Income deal off, ‘not in the public interest’ to proceed in current form: Edwin TongThe scrapping of the deal was announced in Parliament on Oct 14.

Read more »

Ministerial statement: Edwin Tong on blocking of Income-Allianz dealThe Singapore Government has intervened to stop the proposed deal between NTUC Income and German insurer Allianz, under which Allianz would have acquired a majority stake in Income. The announcement of the deal had earlier sparked a public outcry amid concerns about whether Income would maintain its social mission.

Ministerial statement: Edwin Tong on blocking of Income-Allianz dealThe Singapore Government has intervened to stop the proposed deal between NTUC Income and German insurer Allianz, under which Allianz would have acquired a majority stake in Income. The announcement of the deal had earlier sparked a public outcry amid concerns about whether Income would maintain its social mission.

Read more »

Fraying of Allianz-Income deal shocks insiders; coming up with new proposal no easy taskAllianz and NTUC Enterprise were informed of the rejection shortly before the government decision was made public.

Fraying of Allianz-Income deal shocks insiders; coming up with new proposal no easy taskAllianz and NTUC Enterprise were informed of the rejection shortly before the government decision was made public.

Read more »

Govt halts Income-Allianz deal in current form, remains open if public-interest concerns are addressedThe government will put a halt to the deal between NTUC Income and German insurer Allianz to protect public interest, said Minister for Culture, Community and Youth Edwin Tong.

Govt halts Income-Allianz deal in current form, remains open if public-interest concerns are addressedThe government will put a halt to the deal between NTUC Income and German insurer Allianz to protect public interest, said Minister for Culture, Community and Youth Edwin Tong.

Read more »

Government halts Income-Allianz deal to safeguard public interestThe government will put a halt to the deal between NTUC Income and German insurer Allianz to protect public interest, said Minister for Culture, Community and Youth Edwin Tong.

Government halts Income-Allianz deal to safeguard public interestThe government will put a halt to the deal between NTUC Income and German insurer Allianz to protect public interest, said Minister for Culture, Community and Youth Edwin Tong.

Read more »

Allianz to consider revising proposed Income deal; respects Singapore government's positionIncome Insurance also said that it "respects" the government's decision and will work closely with the relevant stakeholders to "study and decide on the next course of action", taking into account the upcoming amendments to the Insurance Act.

Allianz to consider revising proposed Income deal; respects Singapore government's positionIncome Insurance also said that it "respects" the government's decision and will work closely with the relevant stakeholders to "study and decide on the next course of action", taking into account the upcoming amendments to the Insurance Act.

Read more »