(Bloomberg) -- Hong Kong-listed Samsonite International SA is keeping the possibility of a take-private deal open even as the luggage maker considers a dual ...

-- Hong Kong-listed Samsonite International SA is keeping the possibility of a take-private deal open even as the luggage maker considers a dual listing in the US, according to people familiar with the matter.Reddit Soars 48% in Debut as AI Pitch Gets Warm Reception

Shares in Samsonite slid as much as 12% following the company’s announcement Friday, the biggest drop in more than two years.In its statement Friday, Samsonite said the pursuit of a dual listing is at an early stage, and it didn’t mention any exchanges that it might be considering or the potential for a take-private deal.

Samsonite has been considering the possibility of a second listing in the US as a way to broaden its investor base, Bloomberg News reported last year. The company, which raised about HK$10 billion in its Hong Kong initial public offering in 2011, is one of several major consumer brands considering their options as a stock market slump weighs on valuations. Hong Kong’s benchmark Hang Seng Index has fallen more than 40% over the past three years, while Samsonite has climbed 60% in that time.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Samsonite Slumps as Dual Listing Plan Dents Buyout SpeculationSamsonite International SA dropped as the luggage maker’s plans to pursue a second listing risks hurting hopes for a takeover from global buyout firms.

Samsonite Slumps as Dual Listing Plan Dents Buyout SpeculationSamsonite International SA dropped as the luggage maker’s plans to pursue a second listing risks hurting hopes for a takeover from global buyout firms.

Read more »

Samsonite Slumps as Dual Listing Plan Dents Buyout Speculation(Bloomberg) -- Samsonite International SA’s shares fell the most in two years as the luggage maker’s plans to pursue a second listing hurts hopes for a...

Samsonite Slumps as Dual Listing Plan Dents Buyout Speculation(Bloomberg) -- Samsonite International SA’s shares fell the most in two years as the luggage maker’s plans to pursue a second listing hurts hopes for a...

Read more »

Hong Kong-listed Samsonite plans dual listing in hunt for investorsExplore stories from Atlantic Canada.

Hong Kong-listed Samsonite plans dual listing in hunt for investorsExplore stories from Atlantic Canada.

Read more »

Hong Kong's Samsonite International plans to pursue dual listingExplore stories from Atlantic Canada.

Hong Kong's Samsonite International plans to pursue dual listingExplore stories from Atlantic Canada.

Read more »

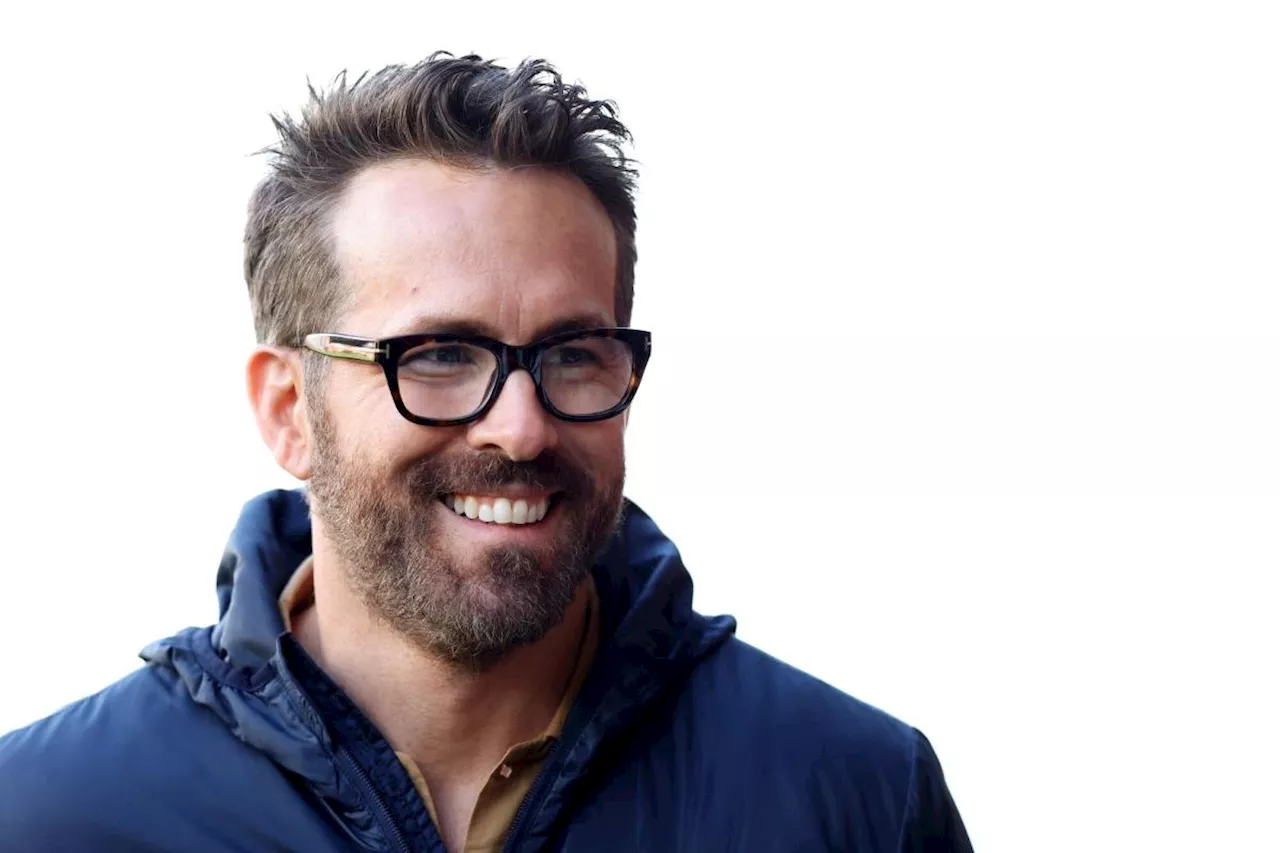

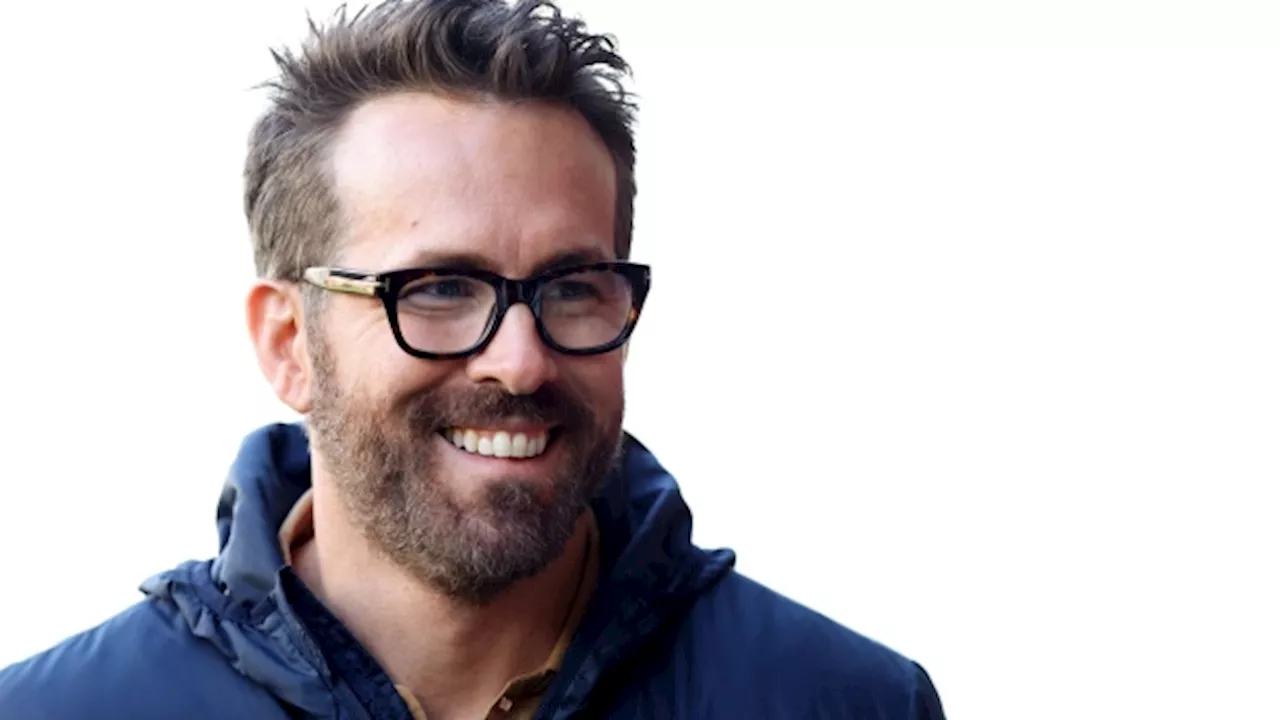

Ryan Reynolds-Backed Nuvei Nears Buyout Deal With Advent: WSJ(Bloomberg) -- Nuvei Corp., the Canadian payments processor backed by actor Ryan Reynolds, is in advanced talks with private equity firm Advent International...

Ryan Reynolds-Backed Nuvei Nears Buyout Deal With Advent: WSJ(Bloomberg) -- Nuvei Corp., the Canadian payments processor backed by actor Ryan Reynolds, is in advanced talks with private equity firm Advent International...

Read more »

Ryan Reynolds-Backed Nuvei Nears Buyout Deal With Advent: WSJNuvei Corp., the Canadian payments processor backed by actor Ryan Reynolds, is in advanced talks with private equity firm Advent International for a buyout, the Wall Street Journal reported, citing people familiar with the matter.

Ryan Reynolds-Backed Nuvei Nears Buyout Deal With Advent: WSJNuvei Corp., the Canadian payments processor backed by actor Ryan Reynolds, is in advanced talks with private equity firm Advent International for a buyout, the Wall Street Journal reported, citing people familiar with the matter.

Read more »