Singapore treasury bills (T-bills for short) are short-term debt securities issued by the Singapore Government. They are available in two formats: six months, or one year, and are issued in tranches several times throughout the year. The minimum investment sum is S$1,000. Due to the fact that the Government has never once defaulted, T-bills carry the highest-possible credit ratings of...

The table above displays the three main differences between six-month and one-year T-bills - tenor, yield and frequency.

However, T-bill yields are determined via auction. According to the latest yields at the time of writing, six-month T-bills have a slightly higher yield — 3.75 per cent over 3.67 per cent. Our investment timeline. If you need your money back within a few months, choosing the six-month T-bill will prove more suitable. Only choose the one-year T-bill if you can remain invested for 12 months or more.

To be sure, the differences between six-month and one-year T-bills are really quite minor — and may be negligible over time. The main consideration really is how soon you may need your money back.To start investing in T-bills, here’s what you’ll need.A Central Depository Account linked to the bank account you want to invest withA CPF Investment Account or SRS Account with DBS/POSB, UOB or OCBCOnce you have set up the appropriate account, you can start applying for the latest available T-bills.

The balance of the issue amount will be awarded to competitive bids from the lowest to highest yields.If T-bills don’t exactly suit your requirements, consider these other securities issued by the Singapore government.Singapore Government Securities bonds pay a fixed interest rate, and are available in a wide range of tenors — from two years to 50 years.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Singapore Reserves Revealed - Singapore Reserves: The Untold Story Part 1Through exclusive interviews with insiders of Singapore Inc', we reveal what exactly makes up the city state's reserves and the hidden' role that they play to make economy tick like clockwork.

Singapore Reserves Revealed - Singapore Reserves: The Untold Story Part 1Through exclusive interviews with insiders of Singapore Inc', we reveal what exactly makes up the city state's reserves and the hidden' role that they play to make economy tick like clockwork.

Read more »

Singapore Reserves Revealed - Singapore Reserves: The Untold Story Part 2This is the untold account of how Singapore's reserves was saved from huge losses in its early years and how it then grew to be big enough to rescue the nation down the road.

Singapore Reserves Revealed - Singapore Reserves: The Untold Story Part 2This is the untold account of how Singapore's reserves was saved from huge losses in its early years and how it then grew to be big enough to rescue the nation down the road.

Read more »

Singapore's key exports fall by 20.2%; 10th consecutive month of declineSINGAPORE: Singapore's non-oil domestic exports (NODX) contracted for the 10th consecutive month in July, falling by 20.2 per cent, with both electronics and non-electronics seeing a decline. The drop follows a

Singapore's key exports fall by 20.2%; 10th consecutive month of declineSINGAPORE: Singapore's non-oil domestic exports (NODX) contracted for the 10th consecutive month in July, falling by 20.2 per cent, with both electronics and non-electronics seeing a decline. The drop follows a

Read more »

Singapore's key exports fall by 20.2%; 10th consecutive month of declineSINGAPORE — Singapore's non-oil domestic exports (NODX) contracted for the 10th consecutive month in July, falling by 20.2 per cent, with both electronics and non-electronics seeing a decline.

Singapore's key exports fall by 20.2%; 10th consecutive month of declineSINGAPORE — Singapore's non-oil domestic exports (NODX) contracted for the 10th consecutive month in July, falling by 20.2 per cent, with both electronics and non-electronics seeing a decline.

Read more »

Singapore releases regulatory framework for single-currency stablecoinsSINGAPORE - Singapore's central bank released a regulatory framework on Tuesday (Aug 15) intended to bolster the stability of single-currency stablecoins. The framework will apply to non-bank issuers of single-currency stablecoins pegged to the Singapore Dollar or any G10 currencies where their circulation exceeds $5 million, said the Monetary Authority of Singapore (MAS). These coins would be labelled as MAS-regulated...

Singapore releases regulatory framework for single-currency stablecoinsSINGAPORE - Singapore's central bank released a regulatory framework on Tuesday (Aug 15) intended to bolster the stability of single-currency stablecoins. The framework will apply to non-bank issuers of single-currency stablecoins pegged to the Singapore Dollar or any G10 currencies where their circulation exceeds $5 million, said the Monetary Authority of Singapore (MAS). These coins would be labelled as MAS-regulated...

Read more »

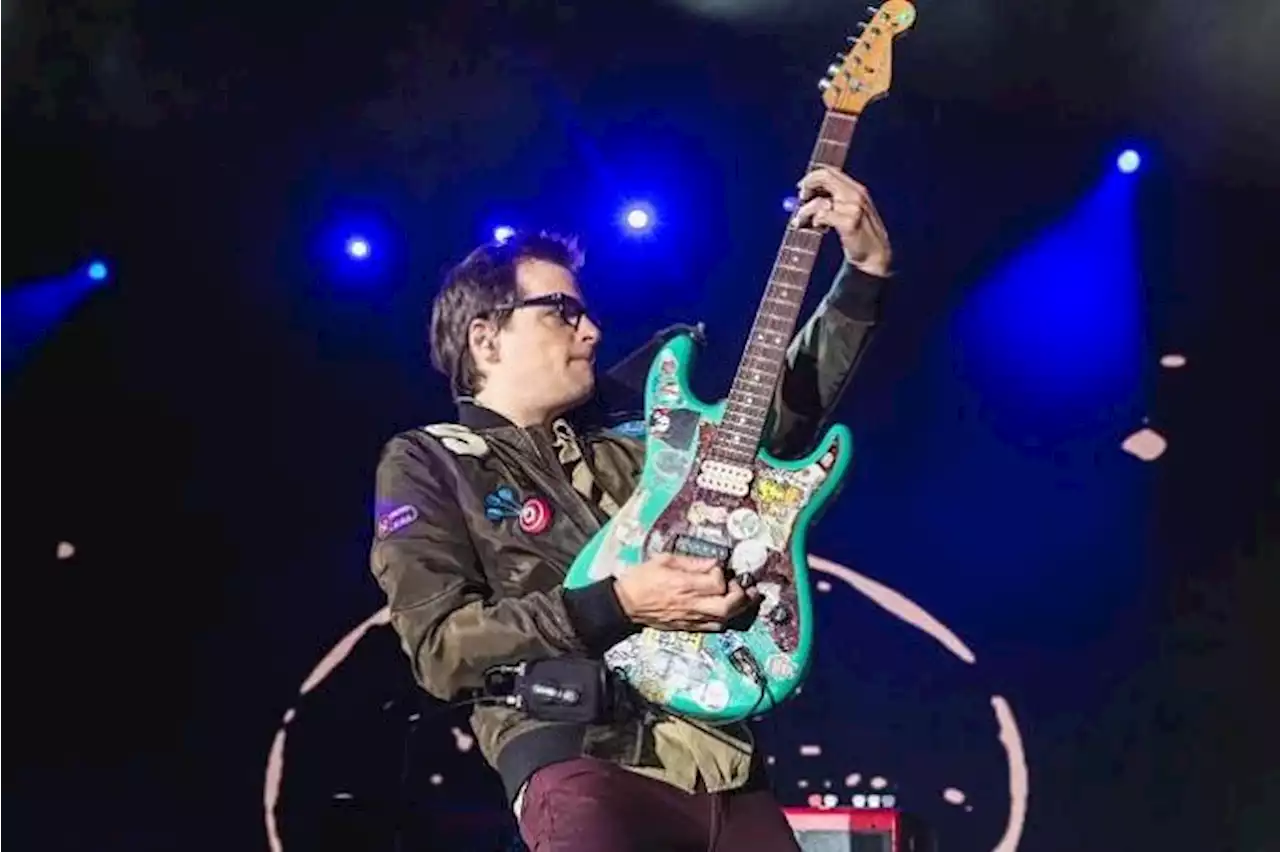

Weezer to perform in Singapore, their only South-east Asian tour stop, in OctoberAmerican rock band Weezer will be back in Singapore to perform at The Star Theatre on Oct 11. Tickets from $98 to $188 go on sale from Friday. According to concert organiser LAMC, the concert is the only South-east Asian stop in the group’s current Indie Rock Roadtrip...

Weezer to perform in Singapore, their only South-east Asian tour stop, in OctoberAmerican rock band Weezer will be back in Singapore to perform at The Star Theatre on Oct 11. Tickets from $98 to $188 go on sale from Friday. According to concert organiser LAMC, the concert is the only South-east Asian stop in the group’s current Indie Rock Roadtrip...

Read more »