⚠️Wall Street Week Ahead: *Risk Assets Will Suffer Greater Pressure After A Dead Cat Bounce 👉 $DIA $SPY $QQQ $IWM $VIX $TLT $CL_F $GC_F

What flipped sentiment from hoping for signs of a slowdown and betting on easing interest rates to going bullish despite economic data supporting a continuously hawkish Fed with members? I think it's the technicals.

The NDX broke through the top of its falling channel, increasing the likelihood of a further rally. Note, the price still has to overcome the June highs and the 50 DMA, but if it manages to, it will have cleared a path to the next resistances, either the Feb 24 low or the flatter downtrend line. To clarify, it doesn't have to get there. It could very well fall back on fundamentals and macroeconomic data. I'm just addressing the technical aspect.

However, what caught my eye was the multilayered contradiction in markets. First, the market narrative dictates that traders are hoping for weak data to reduce pressure on Fed tightening. Economic data throughout the week was positive, and traders still increased risk. That's one contradiction.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

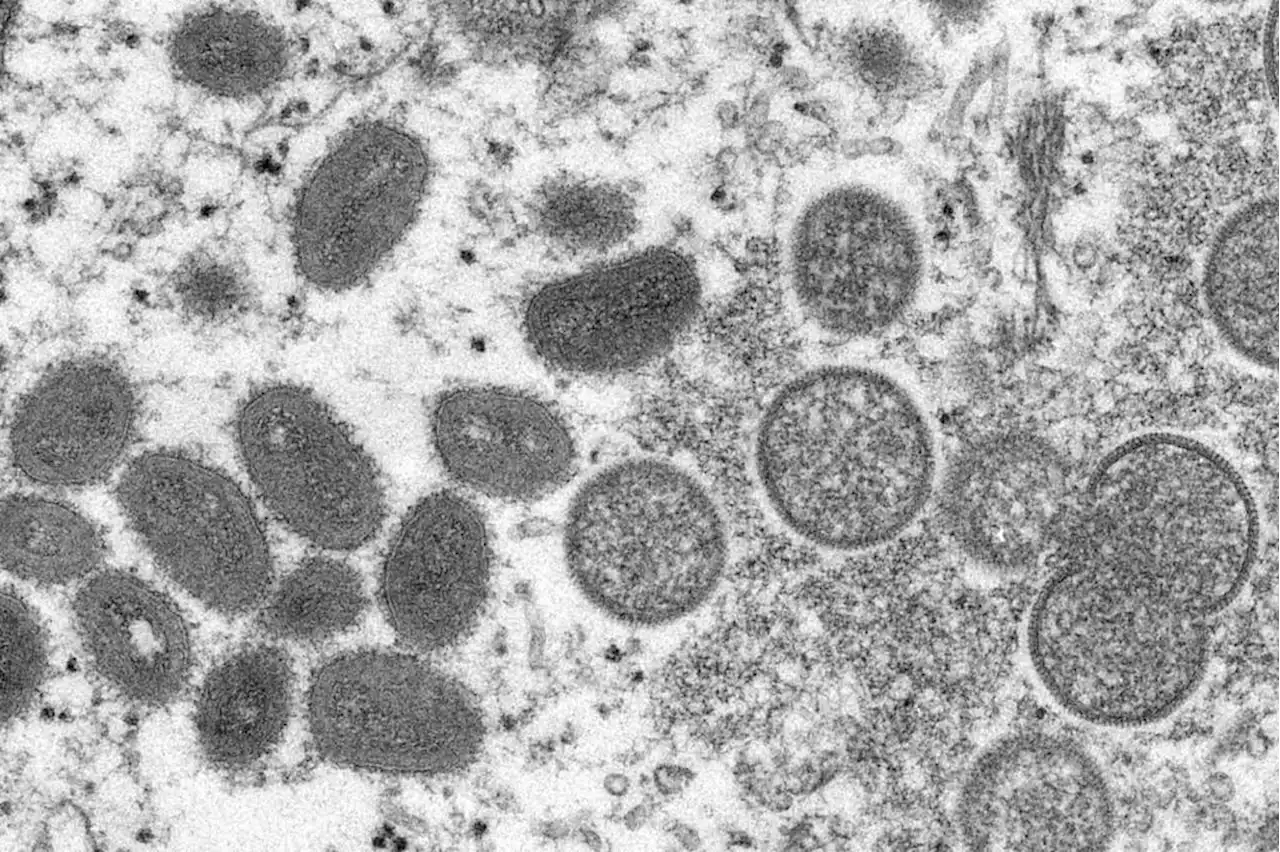

High-risk Coloradans have another opportunity to get monkeypox vaccine next weekColorado will host three more monkeypox vaccination clinics next week focused on high-risk men who have sex with men.

High-risk Coloradans have another opportunity to get monkeypox vaccine next weekColorado will host three more monkeypox vaccination clinics next week focused on high-risk men who have sex with men.

Read more »

Another Hot Inflation Report and the Start of Earnings Season Make for a Challenging Week AheadJune consumer inflation data and the start of the second quarter earnings season could be two catalysts that make for bumpy markets in the week ahead.

Another Hot Inflation Report and the Start of Earnings Season Make for a Challenging Week AheadJune consumer inflation data and the start of the second quarter earnings season could be two catalysts that make for bumpy markets in the week ahead.

Read more »

Weather Authority: Sunny Sunday ahead of hot, humid week of summer weatherGet the sunblock and bathing suits ready, because today is the perfect day to hit the beach!

Weather Authority: Sunny Sunday ahead of hot, humid week of summer weatherGet the sunblock and bathing suits ready, because today is the perfect day to hit the beach!

Read more »

USD/JPY sits near mid-136.00s, over one-week high; lacks follow-throughThe USD/JPY pair recovered its early lost ground to the 135.30 area and turned positive for the fifth successive day on Friday. The intraday uptick pi

USD/JPY sits near mid-136.00s, over one-week high; lacks follow-throughThe USD/JPY pair recovered its early lost ground to the 135.30 area and turned positive for the fifth successive day on Friday. The intraday uptick pi

Read more »