I’m not even retired and I’ve been buying long-term inflation-protected U.S. Treasury bonds in my 401(k) with both hands. Thanks to the recent turmoil in the...

I’m not even retired and I’ve been buying long-term inflation-protected U.S. Treasury bonds in my 401 with both hands.

TIPS are the forgotten cousins of the Treasury market. Their coupons and price adjust to reflect inflation, so that anyone who buys a bond and holds it until it matures is guaranteed a rate of return in “real,” inflation-adjusted, purchasing power terms. John Coumarianos, a financial adviser in Northvale, N.J., says when he tries to talk about TIPS with clients “their eyes glaze over.”

Last week the yield on TIPS bonds spiked to 2% across the board, from the short-term bonds all the way out to the 30 years. In other words, you could buy bonds that guarantee you a return of inflation plus 2% a year for a full 30 years Last year everyone was agog for “I bonds,” a TIPS variant also offered by Uncle Sam, which were paying inflation plus 0%. Now TIPS are paying 2%.

But we don’t buy Treasury bonds for one year. We usually own them for a decade, or several decades. And when we look at those numbers the past becomes startling. Since 1928, the median return from a portfolio of 10 Year Treasurys over any given 10-year period was just 0.85% a year above inflation, and the median return over any given 20 year period was just 0.98%.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Here's how money much Americans in their 50s have in their 401(k)sAmericans in their 50s are nearing retirement, but may not have enough saved up to do so comfortably. Here's how much they have put away.

Here's how money much Americans in their 50s have in their 401(k)sAmericans in their 50s are nearing retirement, but may not have enough saved up to do so comfortably. Here's how much they have put away.

Read more »

Here's how much money Americans in their 50s have in their 401(k)sAmericans in their 50s are nearing retirement, but may not have enough saved up to do so comfortably. Here’s how much they have put away.

Here's how much money Americans in their 50s have in their 401(k)sAmericans in their 50s are nearing retirement, but may not have enough saved up to do so comfortably. Here’s how much they have put away.

Read more »

These bonds, perfect for retirees, are paying twice their historic averageI’m not even retired and I’ve been buying long-term inflation-protected U.S. Treasury bonds in my 401(k) with both hands. Thanks to the recent turmoil in the...

These bonds, perfect for retirees, are paying twice their historic averageI’m not even retired and I’ve been buying long-term inflation-protected U.S. Treasury bonds in my 401(k) with both hands. Thanks to the recent turmoil in the...

Read more »

US Treasury Secretary Says She Didn't Know the Mushrooms She Ate Were PsychedelicUS Treasury Secretary Janet Yellen ate psychedelic mushrooms on a recent trip to China, but did not know they had hallucinogenic properties.

US Treasury Secretary Says She Didn't Know the Mushrooms She Ate Were PsychedelicUS Treasury Secretary Janet Yellen ate psychedelic mushrooms on a recent trip to China, but did not know they had hallucinogenic properties.

Read more »

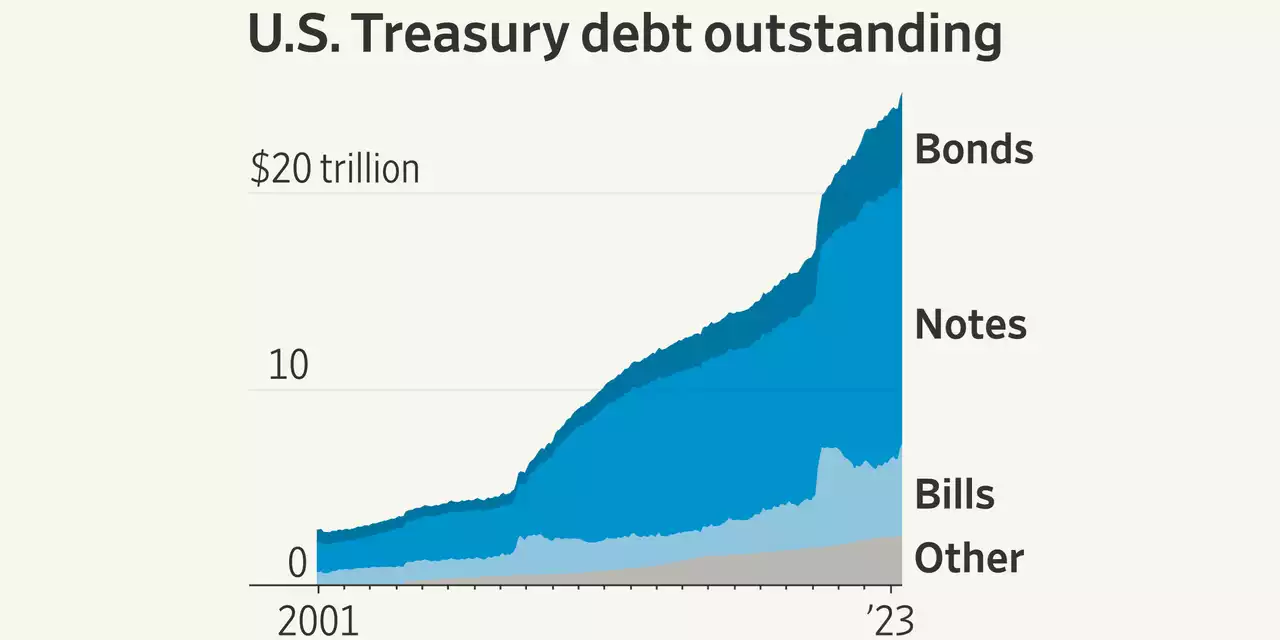

Big Treasury Rout Lures Fresh BuyersBond investors say the summer selloff in U.S. Treasury debt is providing the best buying opportunity in years.

Big Treasury Rout Lures Fresh BuyersBond investors say the summer selloff in U.S. Treasury debt is providing the best buying opportunity in years.

Read more »

Markets Week Ahead: Gold, US Dollar, Nasdaq 100, Treasury Yields, Jackson Hole, ChinaSurging Treasury yields pushed down gold prices as the US Dollar outperformed and equity markets wobbled. Ahead, all eyes are on the Fed’s Jackson Hole Symposium as markets continue watching economic developments out of China.

Markets Week Ahead: Gold, US Dollar, Nasdaq 100, Treasury Yields, Jackson Hole, ChinaSurging Treasury yields pushed down gold prices as the US Dollar outperformed and equity markets wobbled. Ahead, all eyes are on the Fed’s Jackson Hole Symposium as markets continue watching economic developments out of China.

Read more »