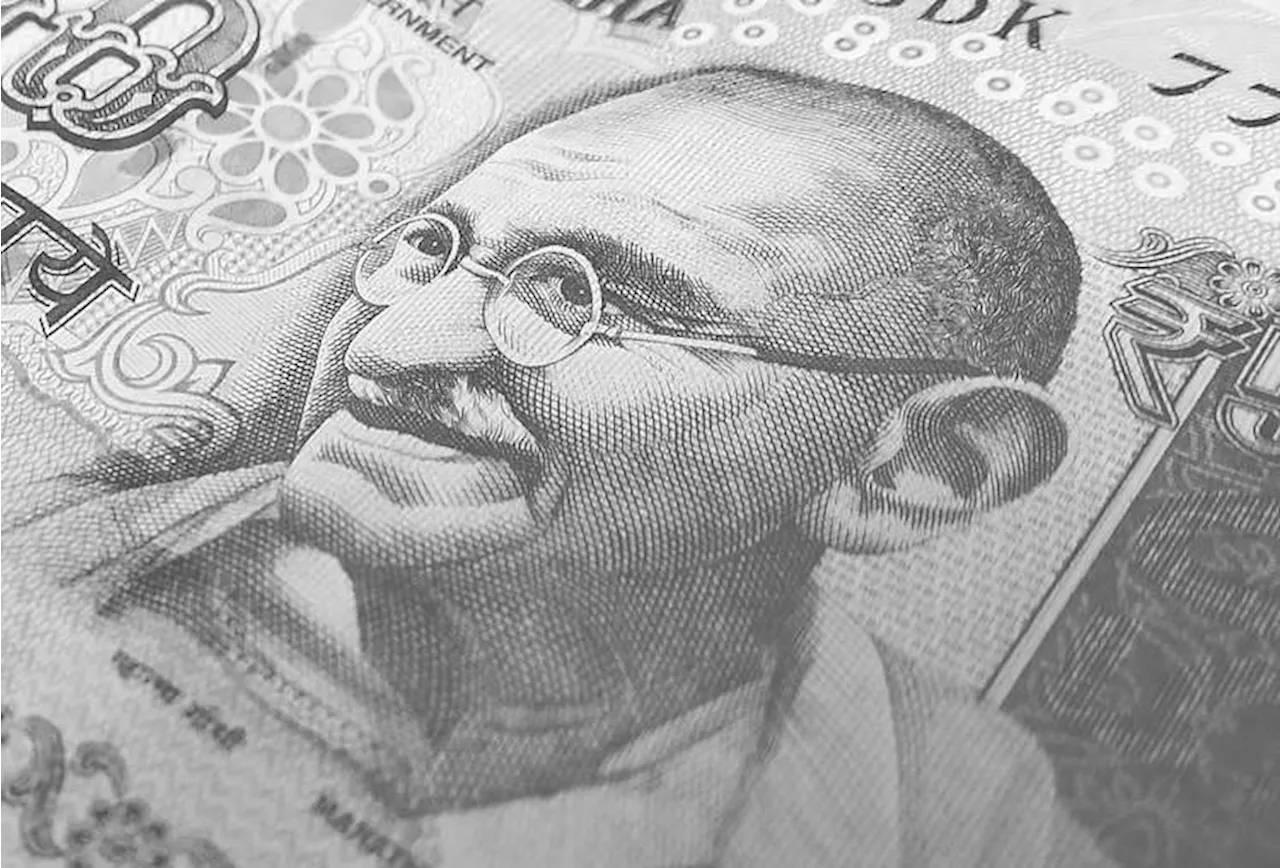

Year-to-date, INR is down 0.6% vs. USD. Economists at Commerzbank analyze Rupee’s outlook. An extended period of elevated Oil prices remains the bigge

st risk factor We project . The main reasons include: Continued strong economic performance. Positive real interest rates. Inflation has moderated steadily since the peak of just under 8% in April 2022 to an average of 5.8% so far this year.

RBI has hiked by 250 bps to 6.50% since May 2022. This implies positive real interest rates at around 70 bps. A stabilization in CNY volatility should also aid INR. However, an extended period of elevated Oil prices remains the biggest risk factor for INR. Source: Commerzbank Research

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USD/INR hovers above 83.20, expects challenge as a RBI swap deal is set to matureUSD/INR trades higher above 83.20 during the Asian session on Tuesday. The Indian Rupee (INR) may face challenges as a $5 billion RBI swap deal is set

USD/INR hovers above 83.20, expects challenge as a RBI swap deal is set to matureUSD/INR trades higher above 83.20 during the Asian session on Tuesday. The Indian Rupee (INR) may face challenges as a $5 billion RBI swap deal is set

Read more »

EUR/USD gains momentum approaches 1.0560s on sentiment improvement, soft USDEUR/USD advanced solidly late in the New York session, as the Euro (EUR) found acceptance at around 1.0550s, with the pair at the brisk of cracking la

EUR/USD gains momentum approaches 1.0560s on sentiment improvement, soft USDEUR/USD advanced solidly late in the New York session, as the Euro (EUR) found acceptance at around 1.0550s, with the pair at the brisk of cracking la

Read more »

USD/CHF holds above the 0.9000 area amid renewed USD demand, US Retail Sales loomsThe USD/CHF pair snaps a two-day losing streak during the early Asian session on Tuesday. The recovery of US Treasury yields lends some support to the

USD/CHF holds above the 0.9000 area amid renewed USD demand, US Retail Sales loomsThe USD/CHF pair snaps a two-day losing streak during the early Asian session on Tuesday. The recovery of US Treasury yields lends some support to the

Read more »

USD/JPY gains traction above 149.60 amid the renewed USD demand, US Retail Sales loomsThe USD/JPY pair holds positive ground around 149.60 during the early European trading hours on Tuesday. A renewed US Dollar (USD) demand and a recove

USD/JPY gains traction above 149.60 amid the renewed USD demand, US Retail Sales loomsThe USD/JPY pair holds positive ground around 149.60 during the early European trading hours on Tuesday. A renewed US Dollar (USD) demand and a recove

Read more »

USD/MXN could reach 18.50/18.75 should US Treasury 10-year yields hit 5.00%+USD/MXN has traded above the 18.00 level. Economists at ING analyze the pair’s outlook. Mexican Peso should be supported on dips There is outside risk

USD/MXN could reach 18.50/18.75 should US Treasury 10-year yields hit 5.00%+USD/MXN has traded above the 18.00 level. Economists at ING analyze the pair’s outlook. Mexican Peso should be supported on dips There is outside risk

Read more »

USD Index: Downside risks should be limited unless 10-year UST yields drop below 4.50%Dollar resumes rally on Middle East crisis. Economists at Société Générale analyze USD outlook. Dollar set to remain supported this week Suspense arou

USD Index: Downside risks should be limited unless 10-year UST yields drop below 4.50%Dollar resumes rally on Middle East crisis. Economists at Société Générale analyze USD outlook. Dollar set to remain supported this week Suspense arou

Read more »