The unravelling of the crypto exchange has been dramatic but it could have been a lot worse if Sam Bankman-Fried’s everyday finance ambitions had been realised.

has delivered many shocks: The $US8 billion in liabilities it couldn’t pay, its huge exposure to its own magic-bean digital tokens, the apparent misuse of customer funds and the mysterious unauthorised withdrawal that drained off a chunk of the money that remained.

With a vibe that was more online brokerage than Bored Ape – and a name that didn’t even nod to crypto, bits or coins – FTX seemed to be normalising digital assets. “SBF had the reputation of being crypto’s legitimate, reliable, good guy,” says Hilary Allen, a law professor at American University Washington College of Law who’s raised concerns about the risks of crypto. His ventures “were seen as more responsible, more establishment players than most other members of the crypto industry.”Until they weren’t. On November 2 the online news site CoinDesk reported on a leaked balance sheet of Alameda, Bankman-Fried’s ostensibly separate trading firm.

If an exchange is simply holding assets on customers’ behalf or acting as middleman for trades, it shouldn’t have a problem dealing with their withdrawals. The details of why FTX.com came up short are still emerging, but theand Reuters, citing unnamed sources, reported that it had moved $US10 billion of its customers’ assets to Alameda.wrote that Alameda had borrowed money to make investments, then turned to FTX to help it make payments on those loans.

Why were people so ready to give money to Bankman-Fried? It helped that he was a character. Just 30 years old, he was famous for his unkempt, curly mane and his uniform of T-shirts and shorts, which he even wore onstage with Bill Clinton and Tony Blair at an FTX-sponsored conference in the Bahamas in April.

For venture capital investors in Silicon Valley, Bankman-Fried was the ultimate cool kid. In a now-deleted article published on the website of Sequoia Capital, one of FTX’s biggest backers, partner Michelle Bailhe, was quoted enthusiastically describing how Bankman-Fried impressed the firm during a video call, even though he was playing the online gamethe whole time. “It was one of those your-hair-is-blown-back type of meetings,” she said.

“FTX was also useful for institutions,” says Campbell Harvey, a finance professor at Duke University. “Indeed, the very genesis of FTX was to provide a low-cost trading venue for his hedge fund Alameda.” Alameda was thought to be largely a market maker – instead of betting on crypto prices moving one way or another, it stepped in to make it easier for other traders to buy and sell tokens. It could earn money on the spread between what buyers were willing to pay for a coin and what sellers were willing to take. But one professional trader, who asked not to be named discussing confidential arrangements, says Alameda was operating more like a risk-taking fund that made directional bets on tokens.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bankman-Fried ran FTX as ‘personal fiefdom’, court hears“Substantial amounts of money” was spent on holiday homes in the Bahamas and other such items, a bankruptcy lawyer has testified.

Bankman-Fried ran FTX as ‘personal fiefdom’, court hears“Substantial amounts of money” was spent on holiday homes in the Bahamas and other such items, a bankruptcy lawyer has testified.

Read more »

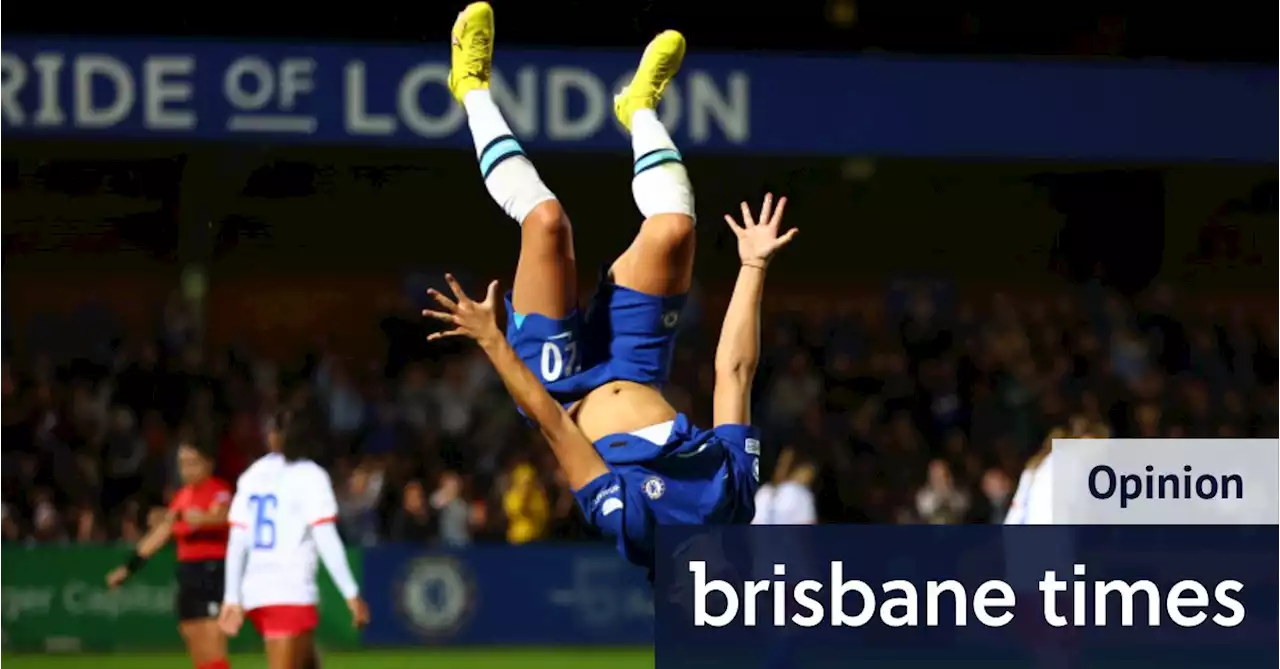

I’d never missed the start of a men’s World Cup. Sam Kerr changed all thatOvernight, two football matches fought for my attention, and unlike in past years, the winner was a no-brainer.

I’d never missed the start of a men’s World Cup. Sam Kerr changed all thatOvernight, two football matches fought for my attention, and unlike in past years, the winner was a no-brainer.

Read more »

I’d never missed the start of a men’s World Cup. Sam Kerr changed all thatOvernight, two football matches fought for my attention, and unlike in past years, the winner was a no-brainer.

I’d never missed the start of a men’s World Cup. Sam Kerr changed all thatOvernight, two football matches fought for my attention, and unlike in past years, the winner was a no-brainer.

Read more »

I’d never missed the start of a men’s World Cup. Sam Kerr changed all thatOvernight, two football matches fought for my attention, and unlike in past years, the winner was a no-brainer.

I’d never missed the start of a men’s World Cup. Sam Kerr changed all thatOvernight, two football matches fought for my attention, and unlike in past years, the winner was a no-brainer.

Read more »

Aftersun review – luminous father-daughter drama starring Paul MescalCharlotte Wells’s debut feature is a stylistically daring, emotionally piercing and beautifully understated tale of love and loss

Aftersun review – luminous father-daughter drama starring Paul MescalCharlotte Wells’s debut feature is a stylistically daring, emotionally piercing and beautifully understated tale of love and loss

Read more »

Drama erupts at World Cup in Qatar after FIFA bans OneLove armbandsThe high drama and controversy surrounding the 2022 World Cup in Qatar has reached new levels after FIFA banned teams from wearing OneLove rainbow armbands at the 11th hour.

Drama erupts at World Cup in Qatar after FIFA bans OneLove armbandsThe high drama and controversy surrounding the 2022 World Cup in Qatar has reached new levels after FIFA banned teams from wearing OneLove rainbow armbands at the 11th hour.

Read more »