Savings account rates may not increase as quickly as they have been over the past year after the Fed’s decision not to raise rates.

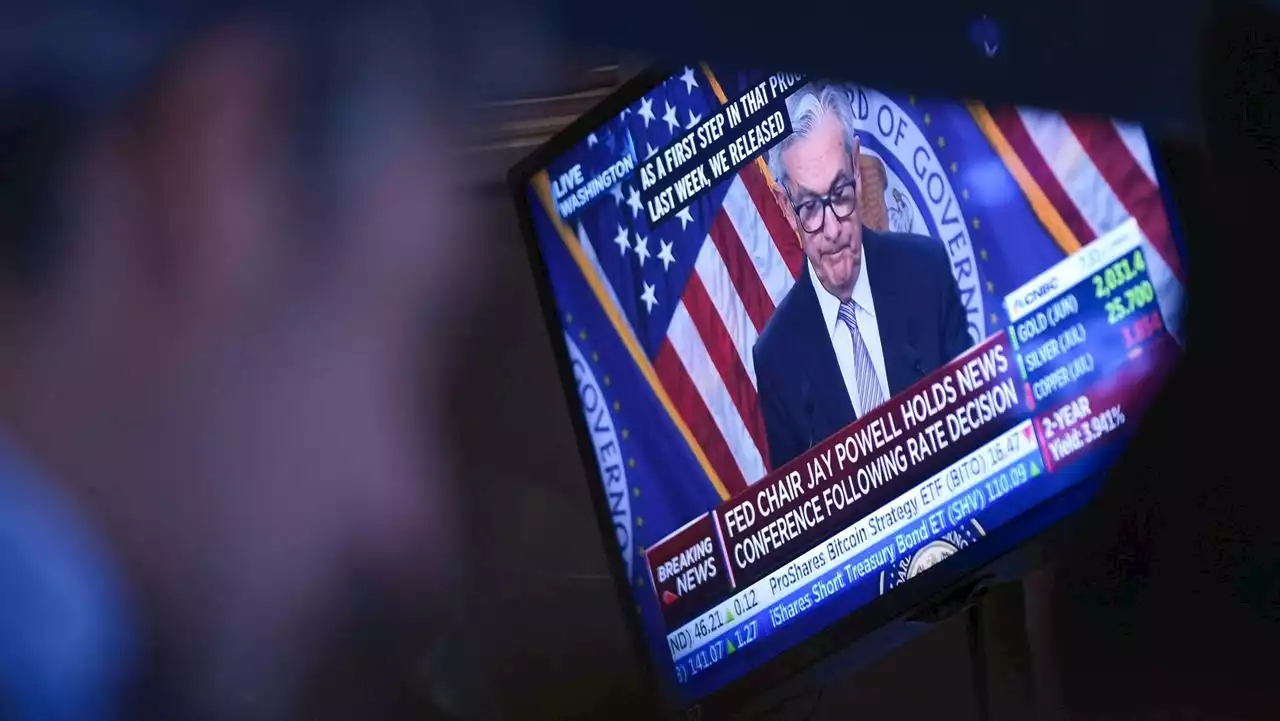

Can savings rates continue to rise without Federal Reserve action? Fed officials concluded a two-day meeting Wednesday and decided not to raise the federal funds rate, breaking a streak of 10 consecutive increases that started in March 2022. The target range remains 5% to 5.25%.

As of May 15, 2023, the FDIC national average savings rate is 0.40%, and some of the best savings accounts earnBut what should savers expect now that Fed officials have paused their increases? Read on to learn more about how the Fed and the federal funds rate could affect your savings rate.It might. Rates certainly won’t increase as sharply as they have in the past year, but you might still see a small increase.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Fed leaves interest rates unchanged for first time in over a yearThe Federal Reserve, having raised interest rates at the fastest pace in four decades, is poised Wednesday to leave rates alone for the first time in 15 months to allow time to gauge the impact of its aggressive drive to tame inflation.

Fed leaves interest rates unchanged for first time in over a yearThe Federal Reserve, having raised interest rates at the fastest pace in four decades, is poised Wednesday to leave rates alone for the first time in 15 months to allow time to gauge the impact of its aggressive drive to tame inflation.

Read more »

CNBC Daily Open: The Fed paused, but so did marketsDon’t see the Fed leaving interest rates unchanged as something positive.

CNBC Daily Open: The Fed paused, but so did marketsDon’t see the Fed leaving interest rates unchanged as something positive.

Read more »

CNBC Daily Open: The Fed paused rates — and the rally in marketsDon’t see the Fed leaving interest rates unchanged as something positive.

CNBC Daily Open: The Fed paused rates — and the rally in marketsDon’t see the Fed leaving interest rates unchanged as something positive.

Read more »

Summer Savings: Score 40% Off Southwest Flights & MoreSubmit that PTO request because you’re going on a (much needed) vacation.

Summer Savings: Score 40% Off Southwest Flights & MoreSubmit that PTO request because you’re going on a (much needed) vacation.

Read more »

The rich often misjudge the potency of their retirement savings, report findsRelative to other income groups, high earners tend to think they're on track for retirement when they're actually not, a new study found.

The rich often misjudge the potency of their retirement savings, report findsRelative to other income groups, high earners tend to think they're on track for retirement when they're actually not, a new study found.

Read more »