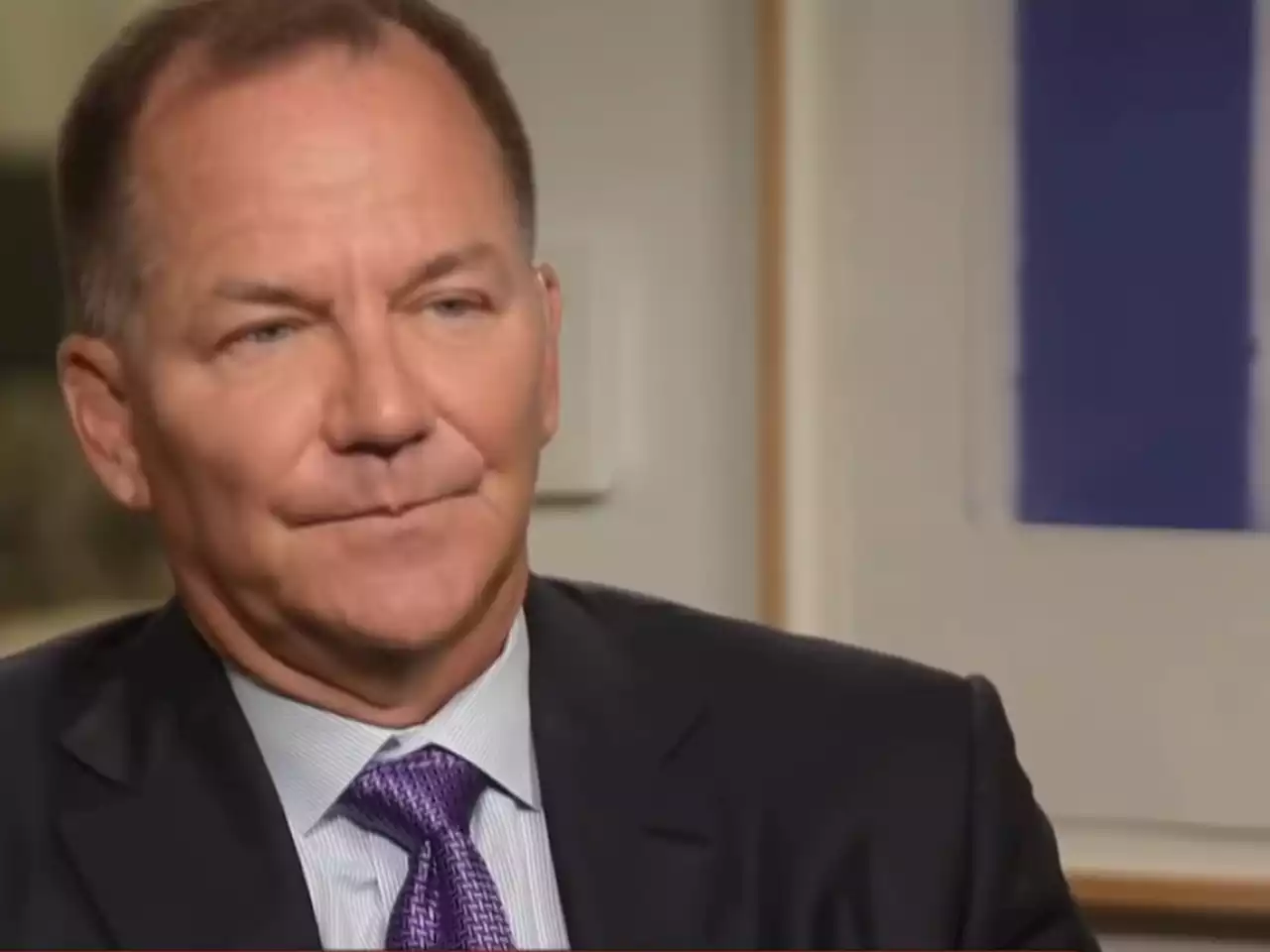

'You can’t think of a worse environment than where we are right now for financial assets,' said Paul Tudor Jones, the billionaire investor who famously called the 1987 stock market crash. He also said investors should make capital preservation a priority.

“‘You can’t think of a worse environment than where we are right now for financial assets…Clearly you don’t want to own bonds and stocks.’”

— Paul Tudor Jones, Tudor Investment Corp. That cheery conclusion comes courtesy of Paul Tudor Jones, the billionaire investor who famously called the 1987 stock market crash and who had previously raised alarm over mounting inflation pressures.In an interview with CNBC on Tuesday, the hedge-fund manager said investors are in “uncharted” territory that should make capital preservation their top priority.

Stocks have stumbled in 2022 as Treasury yields have soared from low levels, with investors attempting to get a grip on a Federal Reserve policy that is now expected to deliver outsize interest rate increases and rapidly shrink its balance sheet as it plays catchup with inflation running at a four-decade high. Investors increasingly fear the backdrop could lead to a recession as the Fed tightens monetary policy in an effort to get inflation under control.

Both stocks and bonds suffered a miserable April, with the S&P 500 SPX, +0.75% sliding nearly 9% and the JPMorgan U.S. Aggregate Bond ETF JAGG, +0.20% dropping almost 4%, according to FactSet data. Rising yields have taken a particular toll on technology and other growth stocks, with the Nasdaq Composite COMP, +0.47% down nearly 20% year to date through Monday and more than 20% below its November record finish, leaving it in a bear market. The S&P 500 was down 12.8% so far this year and slipped back into a market correction last week, while the Dow Jones Industrial Average DJIA, +0.48% was off 9% year to date.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

‘Parent Trap’ Actress Joanna Barnes Dead at 87Looking back at the celebrities who died in 2022 and how their legacies have impacted Hollywood and beyond — details

‘Parent Trap’ Actress Joanna Barnes Dead at 87Looking back at the celebrities who died in 2022 and how their legacies have impacted Hollywood and beyond — details

Read more »

Paul Tudor Jones says he can't think of a worse financial environment for stocks or bonds right now

Paul Tudor Jones says he can't think of a worse financial environment for stocks or bonds right now

Read more »

Paul Tudor Jones Bets on Bitcoin v. Stocks and Bonds Due to Massive New Rate HikePaul Tudor Jones says a lot of intellectual capital is flowing into crypto and that bonds and stocks are the least reliable assets now

Paul Tudor Jones Bets on Bitcoin v. Stocks and Bonds Due to Massive New Rate HikePaul Tudor Jones says a lot of intellectual capital is flowing into crypto and that bonds and stocks are the least reliable assets now

Read more »

Norwegian stock market briefly suffers flash crashThe Norwegian stock market briefly suffered a drop of as much as 4% on Monday in the latest so-called flash crash to hit exchanges.

Norwegian stock market briefly suffers flash crashThe Norwegian stock market briefly suffered a drop of as much as 4% on Monday in the latest so-called flash crash to hit exchanges.

Read more »

Lorde Defends Her Now-Viral Concert Shushing“That dramatic ass move was literally for an album called 'Melodrama,' so don't stress too hard.'

Lorde Defends Her Now-Viral Concert Shushing“That dramatic ass move was literally for an album called 'Melodrama,' so don't stress too hard.'

Read more »

2 people walk away from small plane crash at N.J. airportThe single-engine Cessna crashed at Ocean County Airport, also called Robert J. Miller Airpark.

2 people walk away from small plane crash at N.J. airportThe single-engine Cessna crashed at Ocean County Airport, also called Robert J. Miller Airpark.

Read more »