pstrongIn February, headline inflation was at 3.4 YoY./strong/p pThe rate of price increase slightly slowed to 2.7% YoY in March, data from the Department of Statistics (SingStat) showed./p pa href="https://sbr.com.sg/economy/in-focus/inflation-rises-34-yoy-in-february"In February, inflation was at 3.4%/a.

The rate of price increase slightly slowed to 2.7% YoY in March, data from the Department of Statistics showed.The smaller expansion of the headline or consumer price index -all items inflation was due to a decline in private transport costs and lower core inflation.Other expenditure divisions which saw slower price movements in March were food , services , retail and other goods , accommodation , electricity and gas .

The lower food and services inflation drove the decline in MAS core inflation, which eased to 3.1% YoY in March from 3.6% in February. The Ministry of Trade and Industry and the Monetary Authority of Singapore expect core inflation to"stay on a gradual moderating trend over the rest of the year as import cost pressures continue to decline and tightness in the domestic labour market eases."Excluding the transitory effects of the 1%-point increase in the GST rate to 9%, the agencies expect headline and core inflation to come in at 1.5%-2.5%...

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.SINGAUTO secures $61.

The company will begin mass production of the S1 new energy cold chain vehicle to deliver over 20,000 units by 2025.Colliers transforms Singapore office into regional powerhouseIts iN-Shield initiative is built on the 9 competencies with the best practices on the market that optimises the processes.Its iN-Shield initiative is built on the 9 competencies with the best practices on the market that optimises the processes.

Singapore Latest News, Singapore Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Inflation rises to 3.4% YoY in FebruarypstrongThis is faster following a 2.9% slowdown in January./strong/p pThe prices of goods and services rose to 3.4% year-on-year in February, data from the Ministry of Trade and Industry (MTI) and Monetary Authority of Singapore (MAS) showed./p pHeadline or Consumer Price Index-All Items inflation slowed to 2.

Inflation rises to 3.4% YoY in FebruarypstrongThis is faster following a 2.9% slowdown in January./strong/p pThe prices of goods and services rose to 3.4% year-on-year in February, data from the Ministry of Trade and Industry (MTI) and Monetary Authority of Singapore (MAS) showed./p pHeadline or Consumer Price Index-All Items inflation slowed to 2.

Read more »

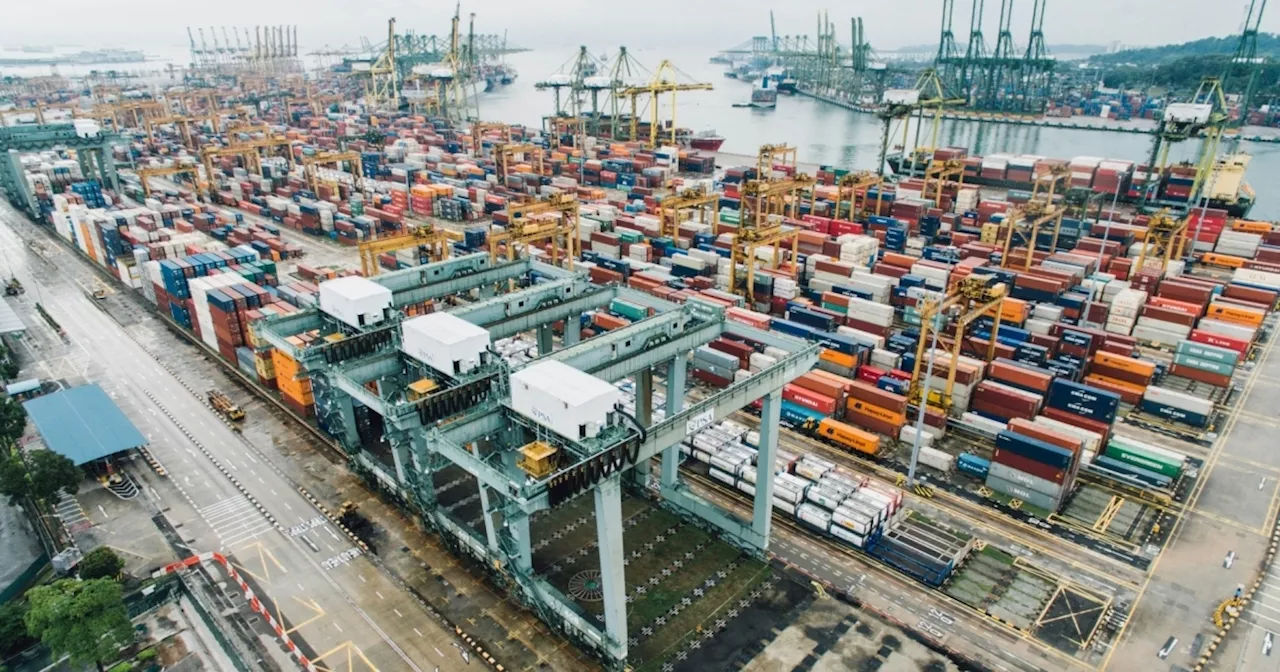

Non-oil domestic exports fall 20.7% YoY in MarchpstrongThe decline in non-electronic NODX contributed largely to the drop. /strong/p pNon-oil domestic exports (NODX) contracted by 20.7% YoY and 8.4% MoM in March, extending thea href="https://sbr.com.sg/economy/news/non-oil-domestic-exports-slip-01-yoy-in-february" decline in February.

Non-oil domestic exports fall 20.7% YoY in MarchpstrongThe decline in non-electronic NODX contributed largely to the drop. /strong/p pNon-oil domestic exports (NODX) contracted by 20.7% YoY and 8.4% MoM in March, extending thea href="https://sbr.com.sg/economy/news/non-oil-domestic-exports-slip-01-yoy-in-february" decline in February.

Read more »

Export decline not tied to global demand, says expertpstrongNon-oil domestic exports a href=" https://sbr.com.sg/economy/news/non-oil-domestic-exports-fall-207-yoy-in-march"fell 20.7% YoY in March.

Export decline not tied to global demand, says expertpstrongNon-oil domestic exports a href=" https://sbr.com.sg/economy/news/non-oil-domestic-exports-fall-207-yoy-in-march"fell 20.7% YoY in March.

Read more »

Investment volume drops 34.7% YoY to $4b in 1Q24pstrongGLS tenders played a significant role in the investment volume./strong/p pInvestment volume hit fell 34.7% YoY to $4.0b in 1Q24, Colliers reported./p pThe investment volume also fell across segments, with the commercial sector posting the largest decline of 52.7% QoQ.

Investment volume drops 34.7% YoY to $4b in 1Q24pstrongGLS tenders played a significant role in the investment volume./strong/p pInvestment volume hit fell 34.7% YoY to $4.0b in 1Q24, Colliers reported./p pThe investment volume also fell across segments, with the commercial sector posting the largest decline of 52.7% QoQ.

Read more »

Singapore’s 1Q24 deals plummet 21.1% YoYpstrongIn the whole of APAC, deal volume declined by 12.2% YoY./strong/p pSingapore’s total deals in the first quarter of 2024, including mergers & acquisitions, private equity and venture financing deals, fell 21.1% YoY./p pData from GlobalData showed that deal activity also fell for Asia-Pacific (APAC) by 12.2% YoY to 3,681 deals.

Singapore’s 1Q24 deals plummet 21.1% YoYpstrongIn the whole of APAC, deal volume declined by 12.2% YoY./strong/p pSingapore’s total deals in the first quarter of 2024, including mergers & acquisitions, private equity and venture financing deals, fell 21.1% YoY./p pData from GlobalData showed that deal activity also fell for Asia-Pacific (APAC) by 12.2% YoY to 3,681 deals.

Read more »

CICT NPI rises 6.3% YoY to $293.7M in 1Q24pstrongGross rental income growth and lower operating expenses drove the uptick./strong/p pCapitaLand Integrated Commercial Trust (CICT) saw its net property income (NPI) increase 6.3% YoY to $293.7m in 1Q24, driven by gross rental income growth and lower operating expenses./p pThe REIT also posted a 2.

CICT NPI rises 6.3% YoY to $293.7M in 1Q24pstrongGross rental income growth and lower operating expenses drove the uptick./strong/p pCapitaLand Integrated Commercial Trust (CICT) saw its net property income (NPI) increase 6.3% YoY to $293.7m in 1Q24, driven by gross rental income growth and lower operating expenses./p pThe REIT also posted a 2.

Read more »